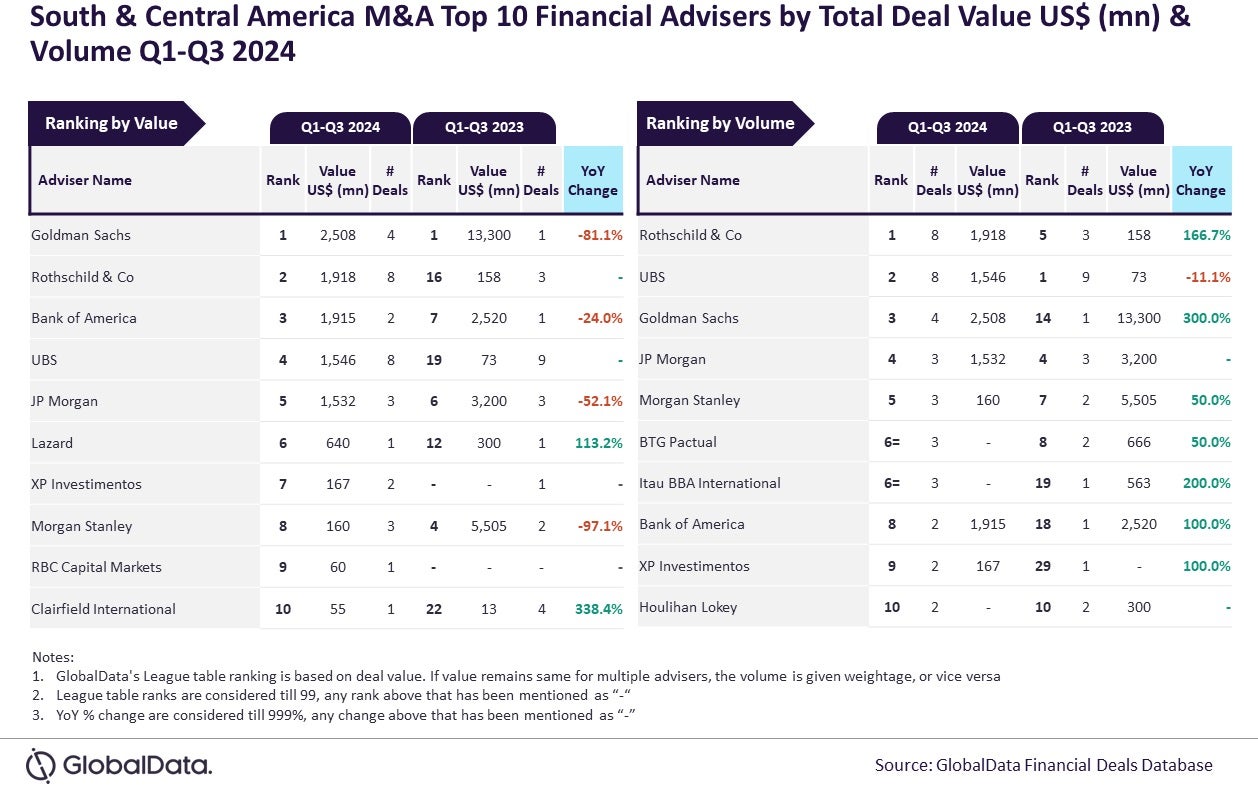

Goldman Sachs and Rothschild & Co have emerged as the leading mergers and acquisitions (M&A) financial advisers in South & Central America by value and volume, respectively, in Q1-Q3 2024, according to the latest financial advisers league table by GlobalData.

According to GlobalData’s Deals Database analysis, Goldman Sachs secured the top spot by advising on deals worth $2.51bn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

GlobalData lead analyst Aurojyoti Bose said: “Rothschild & Co registered growth in the total number of deals advised by it during Q1-Q3 2024 compared to Q1-Q3 2023. Resultantly, its ranking by volume also improved from fifth position during Q1-Q3 2023 to the top position during Q1-Q3 2024. Apart from leading by volume, Rothschild & Co also occupied the second position by value during Q1-Q3 2024.

“Meanwhile, Goldman Sachs was also the top adviser by value during Q1-Q3 2023. However, it registered a significant fall in the total value of deals advised by it during Q1-Q3 2024 compared to Q1-Q3 2023. Despite the decline, it still managed to retain its leadership position by value. Apart from leading by value, Goldman Sachs also occupied the third position by volume during Q1-Q3 2024.”

Rothschild & Co led the volume category with a total of eight deals.

The company also claimed the second spot in the value ranking, advising on deals amounting to $1.92bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIt was closely followed by Bank of America, which advised on $1.91bn worth of deals.

UBS and JP Morgan advised on $1.55bn and $1.53bn worth of deals, respectively.

In the volume rankings, UBS occupied the second position with advisory on eight deals, with the total deal value lower than that of Rothschild & Co.

Goldman Sachs came in third, by volume, with four deals. JP Morgan and Morgan Stanley each advised on three deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory company websites and other reliable sources available in the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness of the data, the company also seeks deal submissions from leading advisers.