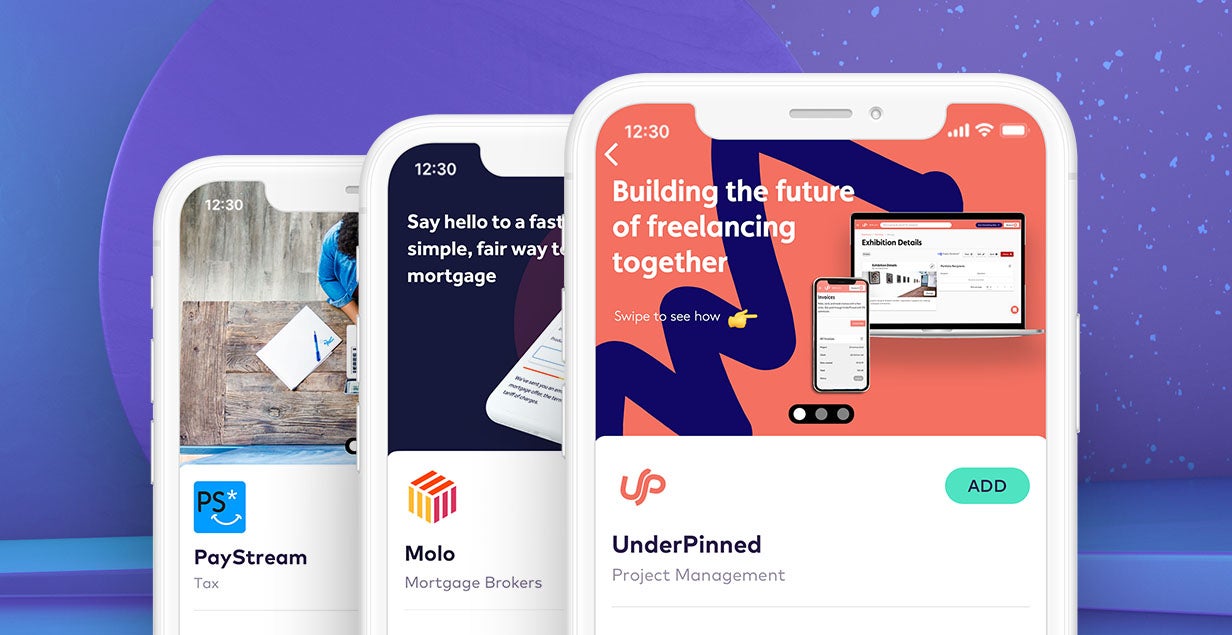

UK digital challenger Starling Bank is adding three new partners – Molo, UnderPinned and PayStream – to its Business Marketplace.

The new partners complement businesses including accounting software packages Xero and QuickBooks and Legal Services provider Sparqa Legal.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Furthermore, expansion of Starling Bank’s Business Marketplace coincides with news that Starling now serves over 100,000 business banking customers.

Molo is an online buy-to-let mortgage lender. It launched in 2018 as the UK’s first fully digital mortgage lender. Specifically, it leverages a proprietary tech platform to deliver a fully online, paperless mortgage decision.

UnderPinned is a career-management platform for freelancers helping them to find work, manage work and get paid. For example, it has launched a full paid-for Virtual Office platform. This means that freelancers can manage every aspect of their working life from portfolio management to creating contracts and payments.

The third new entrant, PayStream, provides digital accounting, payroll and IR35 review services for contractors and freelance workers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataStarling Bank Business Marketplace: 24 partners

The new partners take the total number of integrations available in the Starling Bank Business Marketplace to 24.

Moreover, all partners link with customers’ accounts and data, and are accessible in minutes via the Starling banking app.

Starling CEO and founder, Anne Boden says: “Today’s entrepreneurs have grown accustomed to operating in a world where digital services are crafted around their particular needs. It gives businesses access to a range of services within the app they use for their everyday banking.”

Starling Bank Business Marketplace: no hidden mark-ups

“Francesca Carlesi, co-founder and CEO of Molo, adds: “Making easier, faster, fairer mortgages available to as many people as possible is something we’re truly passionate about.

“Having the support of Starling, an organisation creating such positive change in the industry, is invaluable. We’re excited for what’s to come and thoroughly look forward to working together.”

Like all partners the new entrants are covered by the Starling Promise of no hidden mark-ups. Accordingly, account holders pay the same as they would if they went direct to the provider.