Napier will provide its Transaction Screening solution from the Napier Continuum platform to Starling Bank.

“We chose the Napier platform because the team was able to deploy in just six weeks”, explained Steve Newson, chief technology officer at Starling. “We were incredibly impressed by the innovations within the platform, which supported both a rapid go-live as well as delivering tangible results for us in terms of financial crime compliance.”

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

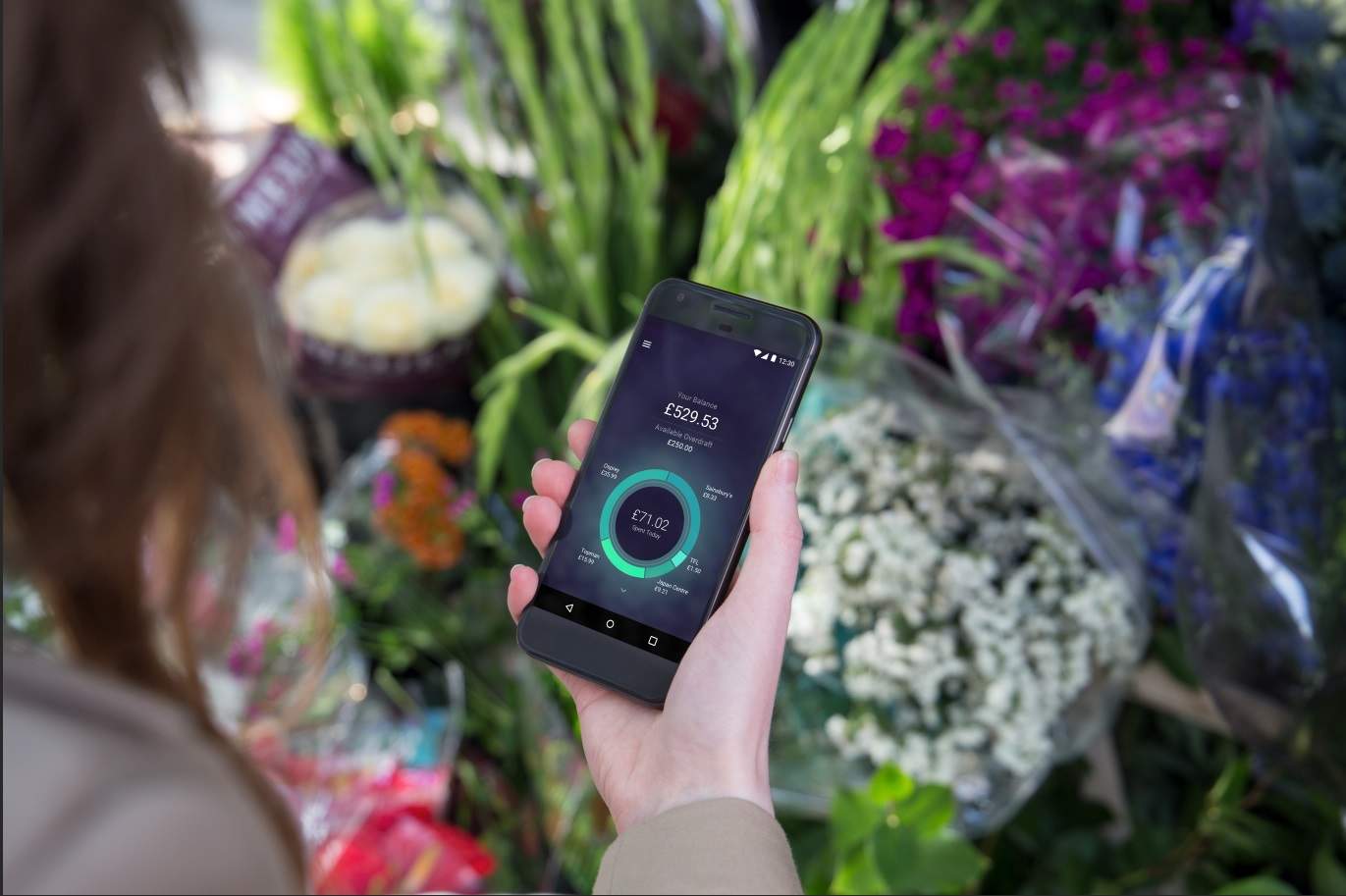

Starling Bank is a digital bank founded in 2014 by Anne Boden. In May, the company reported revenue of £453m for the year to 31 March 2023.

Napier is a fintech specialising in financial crime compliance technology. The company uses AI and machine learning to help business clients detect suspicious behaviours and fight financial crime.

In June 2021, Napier partnered with B2B payment provider ZTL to crack down on money laundering, supplying ZTL with transaction monitoring and client screening options.

Greg Watson, CEO at Napier, also welcomed the partnership with Starling Bank.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Napier is delighted to partner with Starling Bank on its financial crime compliance journey”, Watson commented. “Napier’s innovations, including its Sandbox and no-code configuration of screening scenarios, support financial crime compliance at speed for Starling.”