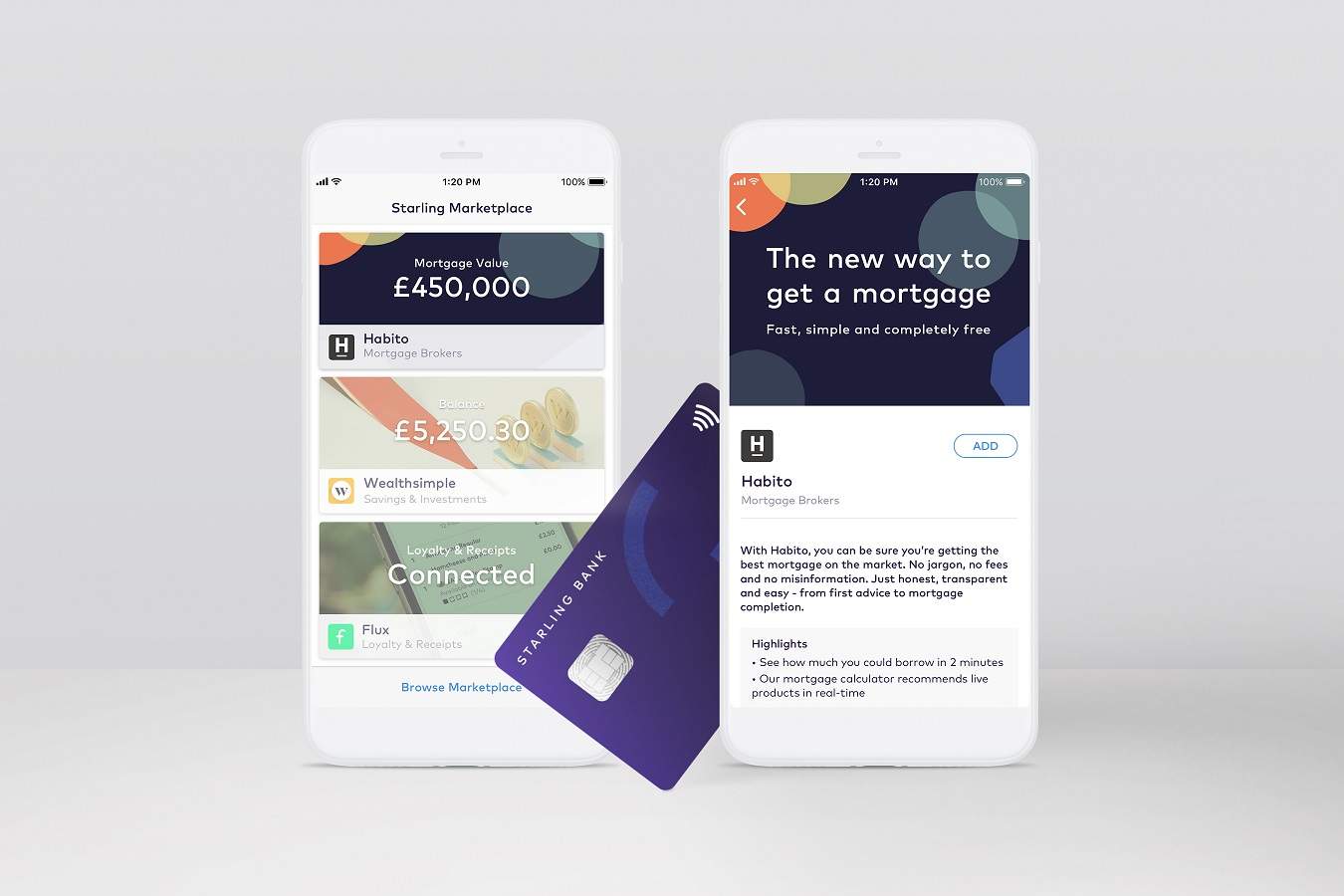

Peer-to-peer lender Growth Street will be added to the mobile-only Starling Bank marketplace later this year.

Growth Street’s aim is to give the five million small business owners in the UK flexible finance to grow.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

It will be the first SME finance provider to go active on Starling’s in-app marketplace. It is also Growth Street’s first marketplace integration and will be the first live use of its third-party API.

To begin, the Starling Bank marketplace interface will work for existing and new users of Growth Street’s SME finance product, GrowthLine. Users will be able to access teal-time information on facility limits and available funds.

Greg Carter, Growth Street CEO, said:“I’m thrilled that we will be going live on Starling’s Business Marketplace. We want to make business finance easier and faster than ever before, and giving users access to crucial information in real time is a great step towards that goal.

“Growth Street shares a vision with Starling: we both want to help businesses grow and prosper. Having the chance to make that happen together is very exciting.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAnne Boden, Starling Bank CEO, said:“All too often, small businesses find it hard to access capital at the moments they need it most, often for reasons they can’t understand or don’t think fair.

“Through our partnership with Growth Street we will be helping Starling’s business account holders unlock new sources of flexible capital. This partnership will bring added value to customers of both Starling for Business and Growth Street.”

While the Starling Bank marketplace has seen many partners, it has also lost some. It dropped TransferWise in May stating it could “provide a better user experience by doing it ourselves”.