A large number of themes were present in banking this year, but these three really took the spotlight and dominated across 2023.

AI

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Artificial intelligence (AI) is everywhere, not just in financial services. In banking, however, the year has been dominated by talks of how to implement AI. Is it just for personalisation? Will it be used to speed up processes in institutions? Or can a good AI actually replace human bankers?

The emergence of ChatGPT increased the conversation, not only amongst each other in the sector, but with the AI itself.

Speaking to PBI, Joseph Twigg, CEO of Aveni, says: “One thing that needs to land with companies is that relatively big change is coming. The impact that this tech is going to have on the way people work is on the same pedestal as the internet.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHani Hagras, chief science officer at Temenos, tells PBI: “Right now, AI is close to unregulated. This is a big problem because any kind of industrial revolution that has come has always come with safeguards. When electricity was invented, it didn’t arrive with naked wires and transformers all over the place.”

Despite banks that are vocal about plans involving AI returning favourable results, only 24% of banking CEOs are publicly discussing their plans.

Cybersecurity

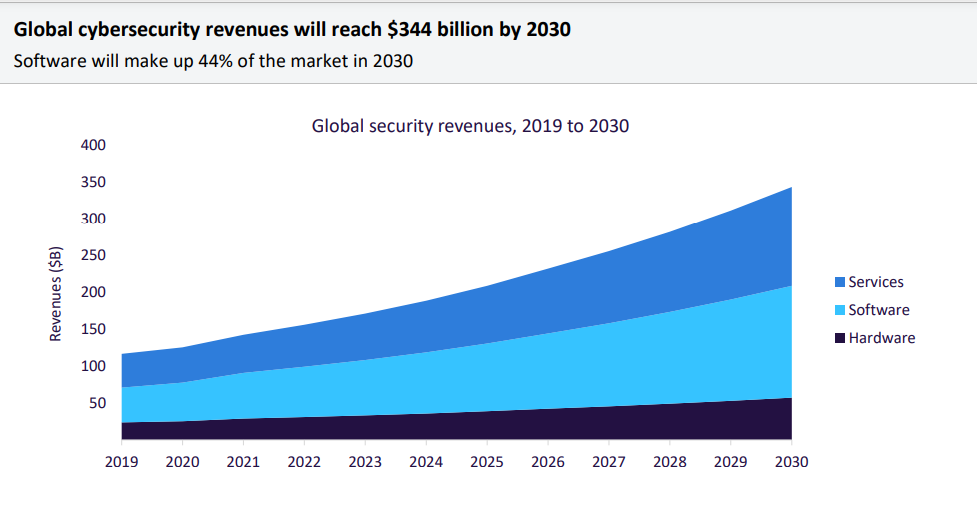

The tech industry is experiencing significant upheaval. Big Tech has made mass layoffs to cut costs, and cybersecurity companies are not immune. However, while IT budgets face scrutiny as companies cut discretionary spending, cybersecurity will remain a priority. Cyber risk is higher than ever, and the consequences of attacks are significant. According to Cybersecurity Ventures, global cybercrime will reach $10.5trn annually by 2025. Tackling this issue requires investment, and GlobalData forecasts that cybersecurity revenues will reach $344bn worldwide by 2030.

Managed security services revenues will be the largest single market segment in 2030. Revenues will increase by a CAGR of 11.4% between 2022 and 2030, reaching $135bn in 2030. Managed security services refer to services that have been outsourced to an external vendor or supplier. Companies facing a cybersecurity skills gap and a growing threat will increasingly outsource security services to external experts.

The next largest market segment will be identity and access management products. Revenues will increase at a CAGR of 11% between 2022 and 2030, reaching $35bn by the end of the period. The rise in cloud computing and distributed workforces makes identity and access management a key preventative security measure as, according to Verizon’s 2022 Data Breach Investigations Report, 82% of all data breaches involve a human element, such as phishing or the use of stolen credentials.

According to GlobalData’s Emerging Technology: Sentiment Analysis Q4 2022 survey, 53% of 251 respondents believe cybersecurity is already disrupting their industry, and an additional 10% believe it will disrupt their industry within the next 12 months.

ESG

Environmental, social, and governance—or ESG—is moving into a different era, which GlobalData calls ESG 2.0.

In this second phase, there will be a greater focus on the ‘E’ component, with a shift from a voluntary regime to a mandatory one, driven by government mandates rather than consumer pressure. A host of new environmental laws are in the pipeline, relating to mandatory reporting, carbon pricing, and carbon import tariffs, as well as more state support and investment in clean energy technologies. Companies unprepared for ESG 2.0 face higher costs and lost sales.

According to the CEO of Hamilton Reserve Bank, Prabhakar Kaza, “more people are convinced to invest in sustainable products. Companies are also very clear that we need to produce more than what we take in and spend. Cost effectiveness is now coming in to play.”

ESG-related M&A activity has climbed in both volume and value over 2022 and has continued to rise in the first quarter of 2023. The deal value was $85bn in Q1 2023, the largest quarter for ESG-related M&A deals over the last five years. GlobalData predicts more rises to come.