GlobalData, a leading data and analytics company, has revealed its league tables for top 10 legal advisers by value and volume in financial services sector for Q1 2021 in its report, ‘Global and Financial Services M&A Report Legal Adviser League tables Q1 2021’.

According to GlobalData’s M&A report, a total of 908 mergers and acquisitions (M&A) deals were announced in the sector during Q1 2021, while deal value for the sector decreased by 16.7% from $174bn in Q1 2020 to $145bn in Q1 2021.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Top Advisers by Value and Volume

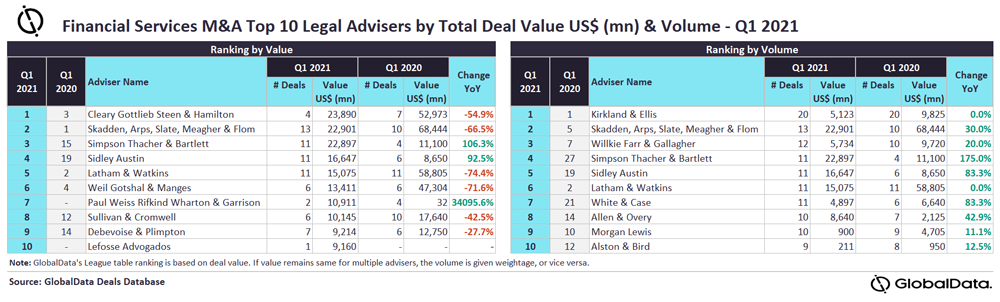

Cleary Gottlieb Steen & Hamilton and Kirkland & Ellis emerged as the top M&A legal advisers in the financial services for Q1 2021 by value and volume, respectively.

Cleary Gottlieb Steen & Hamilton advised on four deals worth $23.8bn, the highest value among all the advisers. Kirkland & Ellis led in volume terms having advised on 20 deals worth $5.1bn.

GlobalData lead analyst Ravi Tokala said: “Cleary Gottlieb Steen & Hamilton’s involvement in the lone megadeal (valued more than or equal to US$10bn) catapulted the firm to the top spot, however, the transaction, Chubb’s proposal to acquire Hartford, was rejected.

“Kirkland & Ellis, which occupied top spot in volume terms, did not even feature among the top ten advisers by value due to its involvement in low-value transactions. While the average deal size of transactions advised by Cleary Gottlieb Steen & Hamilton stood at $5.9bn, it was just $256mn for Kirkland & Ellis.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSkadden, Arps, Slate, Meagher & Flom took the second position by both value and volume with 13 deals worth $22.9bn.

Simpson Thacher & Bartlett secured the third rank by value with 11 deals worth $22.8bn, followed by Sidley Austin with 11 deals worth $16.6bn and Latham & Watkins with 11 deals worth $15bn.

Willkie Farr & Gallagher took the third rank by volume with 12 deals worth $5.7bn, followed by Simpson Thacher & Bartlett and Sidley Austin.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.