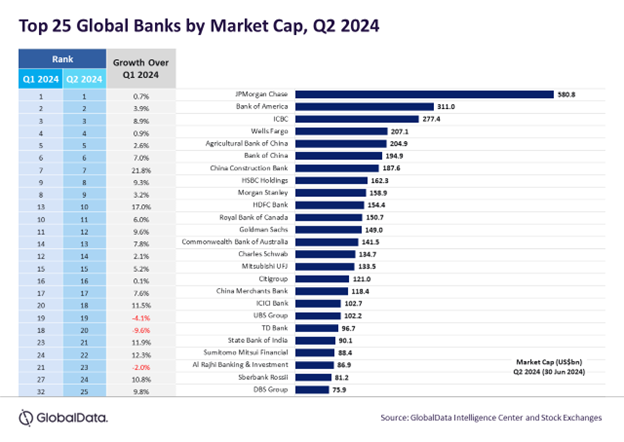

The aggregate market capitalisation (MCap) of the top 25 global banks went up by 5.4% to $4.11trn quarter-on-quarter (QoQ) during the second quarter (Q2) ended 30 June 2024, driven by favourable global economic signals. China Construction Bank and HDFC Bank stocks recorded over 15% growth, while TD Bank saw a decline of nearly 10% in market value. JPMorgan Chase retained its position as the most valuable bank for the ninth consecutive quarter, reflecting resilient performance amid evolving economic landscapes, reveals GlobalData, publishers of RBI.

Murthy Grandhi, Company Profiles Analyst at GlobalData, commented: “Bullish investor sentiment is driven by an expected interest rate cut by the Federal Reserve in September 2024. The US economy, on the other hand, has shown resilience, with real GDP growth rising to 2.5% in 2023 from 1.9% in 2022. It is projected to grow by 2.1% in 2024 even after GDP declined to 1.4% in Q1 2024 from 3.4% in Q4 2023.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“The Federal Reserve’s 2.1% GDP growth for 2024 comes from a potential soft landing, with inflation nearing the 2% target. Overall, investors remain optimistic about banking stocks as central bank rates in the range of 5.25-5.5% stabilise deposit costs, thus easing net interest margin pressure. A strong economy and an expected modest improvement in lending could offer a stable net interest income for banks.”

China Construction Bank (CCB)

CCB’s stock value surged by 21.8% during Q2 2024, driven by its robust capital position and attractive valuations. This rise came on the back of a solid Q1 2024, when the bank reported a CNY1.17 trn increase in gross loans and advances to customers, compared to the previous fiscal year ended December 31, 2023. Additionally, financial investments grew by CNY247.151bn, while customer deposits increased by CNY1.71trn.

HDFC Bank

HDFC Bank’s market value gained 17% to end Q2 2024 with MCap of $154.4bn. Strong quarterly results that met investor expectations and rising optimism about the bank’s future performance were the catalysts. HDFC Bank is expected to reclaim its industry-leading profitability, benefitting from an improved loan mix and normalised funding costs.

Grandhi continues: “JPMorgan Chase continued to consolidate its status as the world’s leading bank with yet another quarter of strong results. It reported a 9% increase in net revenue to $41.9bn compared to Q1 2023. This growth was primarily driven by an 11% rise in net interest income, attributed to the acquisition of First Republic, and a 7% increase in non-interest revenue, spurred by higher asset management fees and reduced net investment securities losses in the treasury and chief investment office businesses.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTD Bank

MCap of TD Bank eroded by 9.6% to $96.7bn from the previous quarter, following a US-led probe into alleged laundering of proceeds from illicit drug trafficking through its branches. TD has been under pressure to outline its next growth phase following an ambitious expansion into US retail banking with $1.3bn acquisition of New York-based dealer Cowen Inc. last year. The bank had also planned a $13.4bn deal to acquire Tennessee-based First Horizon Corp., but this was terminated after regulatory investigations into anti-money laundering lapses delayed necessary approvals.

Chinese Big Four banks

The market value of China’s top four banks – ICBC, Bank of China, Agricultural Bank of China, and China Construction Bank – experienced growth in the range of 3%-22%. All these banks experienced a decline in net interest margins for the quarter ending in March 2024 due to various factors, including a reduction in the loan prime rate and low market interest rates.

Grandhi concludes: “The performance of global banks in the second half of 2024 will be shaped by several key factors, including economic conditions, monetary policies, and inflation. Geopolitical factors, including trade tensions and conflicts, could affect international operations and market stability. Regulatory scrutiny, as seen with TD Bank, will also impact strategic initiatives and performance. Overall, while challenges remain, the combination of potential rate cuts, economic resilience, and technological progress may benefit global banks.”