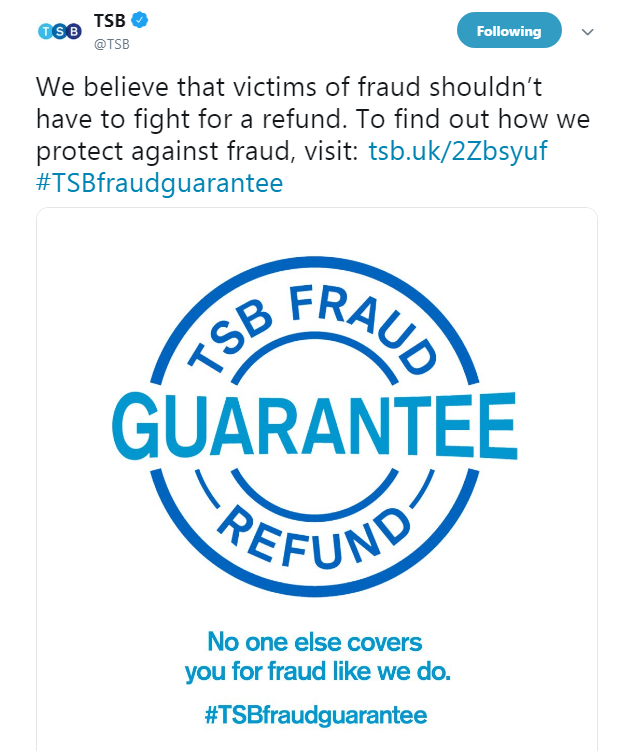

TSB has launched its Fraud Refund Guarantee solution to protect its 5.2 million customers.

The guarantee is a first for UK banks as TSB tackles a growing problem. The move will put its customers at the heart of a new strategy that aims to tackle fraud in an extremely digital age.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The TSB Fraud Refund Guarantee will cover all transactional fraud losses. This includes cases where a customer is tricked into authorising payments to online hackers.

The guarantee applies to losses incurred by new and existing customers on or after Sunday 14 April.

On its website, TSB stated:

“All too often people who have money taken out of their account by fraudsters have to fight to get their money back. Even though this is the last thing you feel like doing if you’re the victim of crime.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Our Fraud Refund Guarantee means that you will get a refund even if you make an honest mistake. Whether you accidentally click on something you shouldn’t, or you share some sensitive information without thinking. As long as you’re an innocent victim, we’ll refund you.”

Setting it apart from its high street rivals, TSB hopes to regain the confidence of its customers and encourage new customers to join.

TSB Fraud Refund Guarantee

In general, customers that get caught up in fraud are entitled to a refund. However, TSB wants to clear up the grey area in some cases. It will also cover customers that unwittingly authorised transactions to fraudsters. Often in these cases, customers can be fighting for ages to get their money back.

Richard Meddings, acting TSB executive chairman, commented: “The vast majority of fraud claims across UK banking are from innocent victims of fraud who have been targeted by criminals and organised gangs.

“However, all too often these customers must fight to be refunded and are not treated as victims of crime.”

Claiming on the guarantee

TSB stated that it won’t cover customers that actively ignore advice given and therefore continue to be affected by fraud.

However, to claim the TSB Fraud Refund Guarantee, the bank has laid out its guidelines:

- TSB customers will need to contact the bank and report the fraud by calling the number on the back of their card or 0800 096 8669.

- The bank will investigate the fraud claim fully.

- Customers may need to reset their login details or other account information.

- If successful, the refund will be paid back into your account as quickly as possible.

The TSB Fraud Refund Guarantee doesn’t change how the bank will investigate claims, it just expands the claiming back capabilities.

A look back at the IT chaos

Between Friday 20 April and Sunday 22 April, TSB notified its customers that upgrades to its systems would be carried out. This was all very normal and customers understood that during this time they wouldn’t be able to access normal banking services.

However, while migrating customers to the new system, technical faults erupted that saw customers locked out of their accounts and some were even able to view other people’s balances.

The IT chaos continued for months after. In June the FCA announced that would be investigating the migration process alongside the Prudential Regulation Authority.

Overall, the months of IT issues led to a loss of £107.4m for the first six months of the year.

Furthermore, approximately 26,000 customers closed their accounts with TSB. Confidence with the bank is still low but the TSB Fraud Refund Guarantee hopes to change that.

To ensure customer satisfaction, TSB created a team of 260 staff to make sure no customer was left out of pocket.