First off, let’s focus on the positives. The UK’s seven day switching service remains out on its own in global retail banking. There is no other comparable service in any other major retail banking market. And there is some limited cause to celebrate the full year figures for 2024. Specifically, the service processed over 1 million switches for the second consecutive year.

Another 2024 highlight was the week of 12 April, a record week, with 57,874 switches taking place.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

It was always going to be a stretch to match the record switching statistics reported in 2023. The year-on-year drop for calendar year 2024 comes as no surprise.

In calendar year 2023, some 1,457,165 switches were reported. The 2024 numbers represent a year-on-year drop of over 266,000 switches or 18.2%.

The record for quarter for switching remains the fourth quarter of 2023 with 433,701 switches. The corresponding quarterly figure in the fourth quarter of 2024 shows a y-o-y drop of 28% to 309,290.

11.4 million switches since September 2013

The service launched initially in September 2013. So, in the intervening period, there are 45 quarters of data to consider. In total since launch, UK seven-day switching has successfully completed 11.4 million switches.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOn the other hand, it would be inaccurate to say that seven-day switching has transformed consumer behaviour. Back in 2012, the year before the service launched, there were 1.2 million switches.

The annual total dipped then in each of the next four years, to 1,033,939 in 2015 and to 1,010,423 in 2016. By 2017 (931,956) the figure was back below the one million total and fell again to 929,070 in 2018. By 2021, the annual number had fallen even further to 782,223.

In other words, total switching in 2024 is flat compared with the year prior to the service launching. It means that only around 2.5% of UK adults that hold a current account switch their primary account each year.

Q3 2024 brand by brand switching stats: NatWest the biggest loser

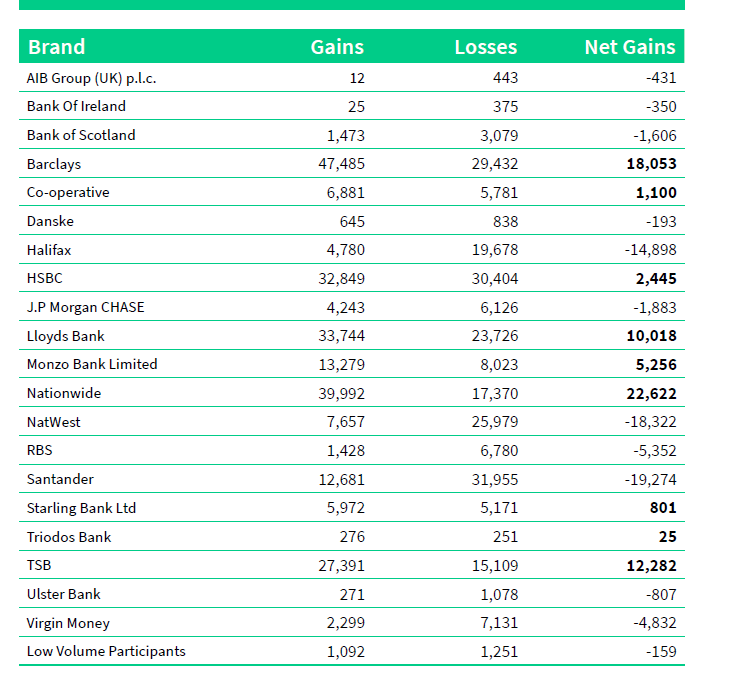

End user data is always released three months in arrears. So, the latest switching data on a brand-by-brand basis cover the period from July to September 2024. Nationwide had the highest net switching gains with 22,622, followed by Barclays (18,053), TSB (12,282) and Lloyds (10,018).

The biggest net losers by brand in Q3 2024 are Santander, NatWest and Halifax.

And the swing in the NatWest numbers compared with exactly 12 months ago highlights a recurring theme in the 45 quarters of data. That is, the impact of successful account switching promotions.

The quarterly brand-by-brand stats for Q3 2023 show NatWest as the biggest winner, with a net 59,000 gains. During that quarter, NatWest, along with sister brand RBS, HSBC and TSB, ran a successful account switching promotion. NatWest had no such promotion in the third quarter of 2024. That results in NatWest plummeting from biggest net gainer a year ago to the second biggest net loser in the latest brand statistics.

Nationwide – a decade of market share gains

It is no surprise to see Nationwide as the biggest net gainer in the Q3 2024 stats. Of all the 54 participating banks and building societies, it is the overall big winner in the 11 years of seven-day current account switching. Nationwide regularly offers the most generous account switching incentives. In 2013, Nationwide held a current account market share of about 6.2%. Today, that figure has risen to approaching 11%.

Online or mobile banking (46%) remains the top reason people preferred their new account. This has consistently been the case for consecutive quarters. This was followed by interest earned (37%) and customer service (32%). Notably, spending benefits, such as cashback and account fees or charges, secured the fourth spot at 27%, a level not seen since the start of 2023.

Customer satisfaction current account switching remains impressively high

Some 91% of Current Account Switch Service customers are satisfied with the process and 90% would recommend it.

Almost all (99.7%) switches were completed within seven working days.

John Dentry, Product Owner at Pay.UK, owner and operator of the Current Account Switch Service, said: “2024 was yet another busy year for the Service. These figures are ultimately being driven by increasingly money-conscious consumers. Banking institutions, whether they be neobank disruptors or traditional high street banks, continue to present diverse, innovative and increasingly generous offers to win over hot-footed switchers.

“We’re pleased to see such high satisfaction and completion rates, cementing the Service’s position as critical infrastructure which enables a healthy and competitive banking marketplace. Whether it’s a business or an individual, the Service will continue to guarantee switching current accounts remains a quick, free and easy process.”