UK current account switches are up by 3.7% from the year ago period.

In the past 12 months (1 October 2018 to 30 September 2019) there were 975,571 switches. That is up from 941,122 in the 12 month period to end September 2018.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

On the other hand, switching totals remain below past levels.

For example, in the 12 months to end September 2016 there were 1,059,674.

The Current Account Switch Service has now completed over 6 million switches since its launch in September 2013.

The service launched following a recommendation from the Independent Commission on Banking in 2011. That report notes that UK consumers only changed bank accounts once every 26 years on average.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAround 46 million UK adults hold a current account. So with an average of around 1 million switches per year only around 2% of account holders are switching.

Such a low switching rate was not in the script for the UK government when 7 day switching was launched.

Awareness and satisfaction levels remain consistently high at 81% and 91% respectively.

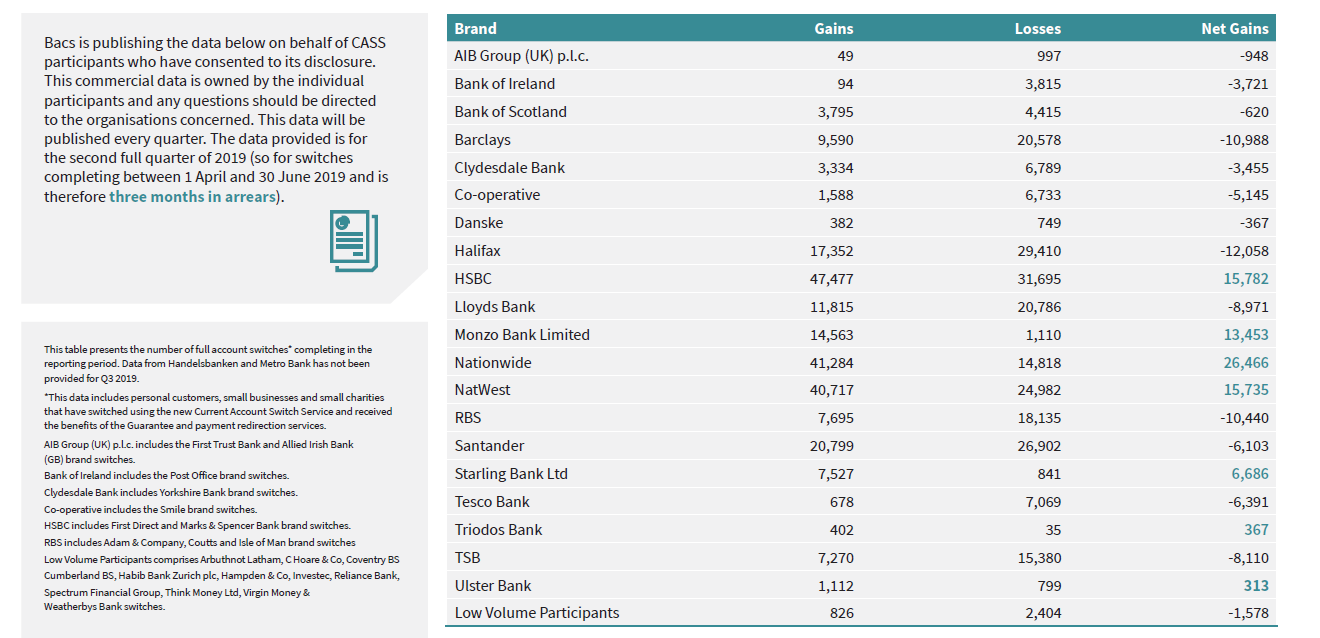

UK current account switches: winners and losers

Nationwide Building Society is again the biggest winner ahead of HSBC, their positions unchanged from the prior quarter.

Nationwide continues its successful long-term drive to post current account market share gains. In the past six years it has grown its market share from 6% to over 8% of UK current accounts. In the first quarter Nationwide net seven day switching gains total more than 26,000.

Over the same period HSBC and NatWest are ahead by almost 16,000 switches.

Monzo and Starling Bank show the next highest number net gains for the second quarter in a row.

The biggest loser is again Lloyds Banking Group, down by more than 21,000 across its three brands.

TSB’s challenges continue following its well publicised IT meltdown in 2018, losing another 8,000 switchers.

7 day switching: over 35s more likely to complete a switch

Age continues to be a key indicator of switching behaviour. Younger people (37% of under 25s) more commonly leave their old account open when getting a new one. This compares to only 17% of over 35s.

Over 35s are more likely (65%) to complete a switch using the Current Account Switch Service than under 25s (42%).