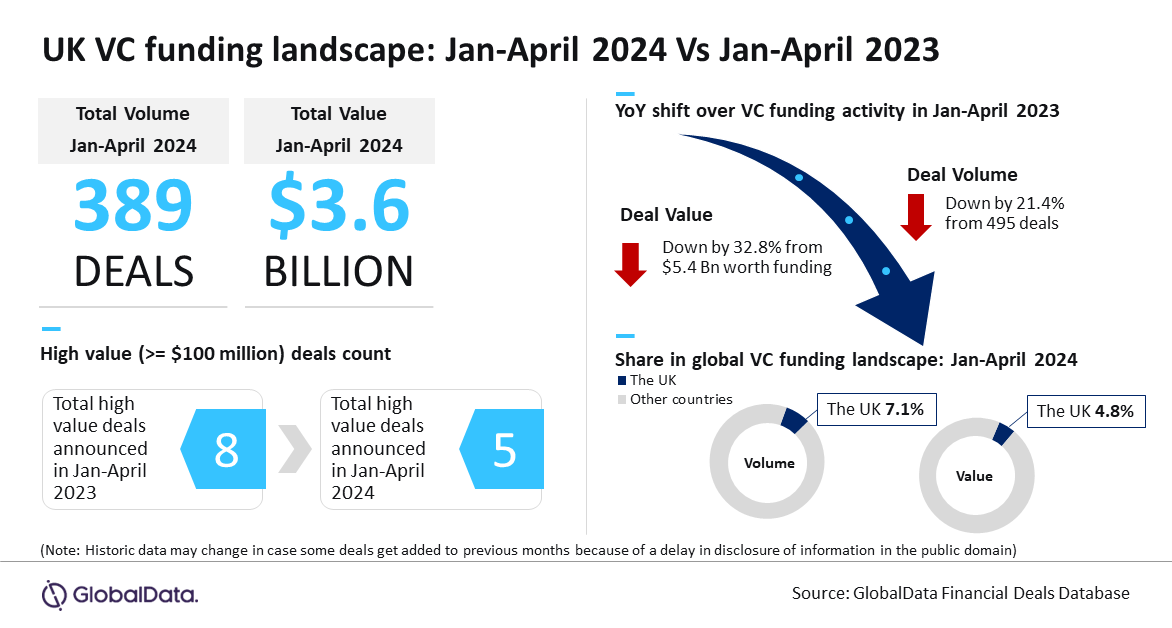

The UK witnessed the announcement of a total of 389 venture capital (VC) funding deals of worth $3.6bn during January-April 2024. This is a year-on-year (y-o-y) decline of 21.4% in terms of deal volume and 32.8% in terms of value, according to GlobalData publishers of RBI.

An analysis of GlobalData’s Deals Database reveals that a total of 495 VC deals were announced during January-April 2023 while the corresponding value of these deals stood at $5.4bn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Aurojyoti Bose, Lead Analyst at GlobalData, said: “Venture funding activity declined considerably in the UK as global economic headwinds are taking toll on investor sentiments. The UK also saw a fall in volume of high-value VC deals (≥ $100m) during January-April 2024 compared to the same period in previous year.”

The high-value VC deals include $431m raised by Monzo, $112m capital by Exohood Labs, $110m by Skyports, $110m capital by Build A Rocket Boy and $100m funding by Oxford Quantum Circuits.

Bose added: “Despite the setback, the UK continues to remain the top European market for VC funding activity and is also among the top five global markets in terms of deal volume as well as value.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe UK accounted for 7.1% of the total number of VC deals announced globally during January-April 2024 while its share in terms of corresponding value stood at 4.8%.