An independent survey asked retail banking customers whether they would recommend their bank to friends and family: their answers reveal how banks have performed over the last 6 months since February 2020.

The survey by UK government website Gov.uk involved about 1,000 customers of each of the 19 largest personal current account providers in Great Britain and about 500 customers of each of the 9 largest personal current account providers in Northern Ireland.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The results are only published where at least 100 customers have provided an eligible score for that service in the survey period.

Great Britain (England, Wales and Scotland)

Participating providers: Bank of Scotland, Barclays, Clydesdale Bank, first direct, Halifax, HSBC UK, Lloyds Bank, Metro Bank, Monzo, Nationwide, NatWest, Royal Bank of Scotland, Santander, Starling Bank, Tesco Bank, The Co-operative Bank, TSB, Virgin Money, Yorkshire Bank.

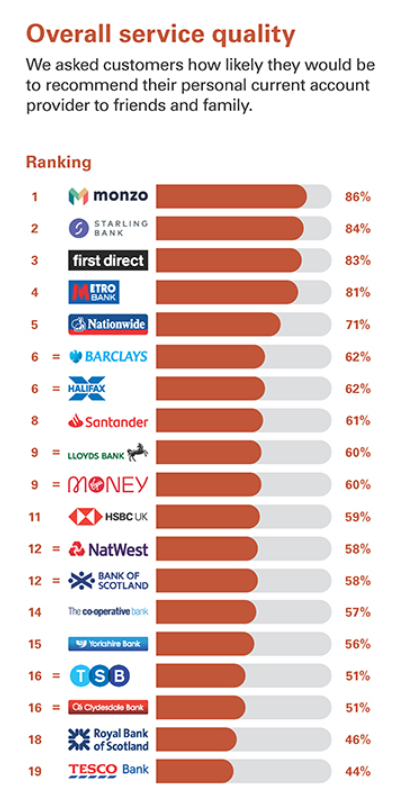

Overall service quality

Customers were asked how likely they would be to recommend their personal current account provider to friends and family.

Challenger bank Monzo retains the crown it achieved last year, when it toppled previous winner First Direct (styled first direct), to take the top spot in overall service quality. 86% of respondents would encourage friends and relatives to sign up with Monzo.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDatafirst direct, a telephone and internet-based retail bank division of HSBC, came in third this time (83%) following mobile-only challenger Starling bank in second place (which boasts 84% of customers willing to advocate for it).

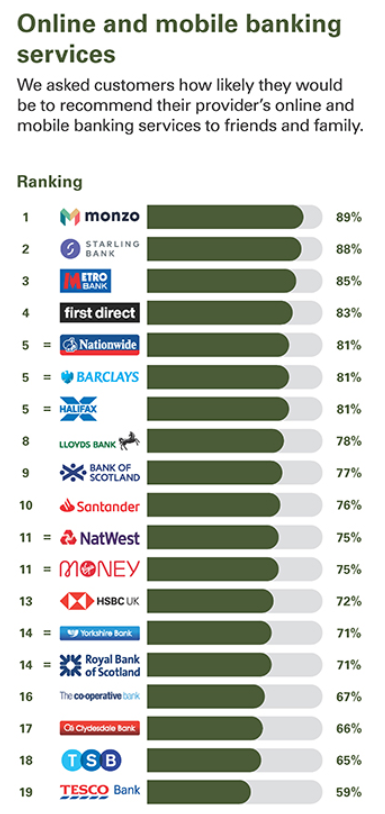

Online and mobile banking services

How likely would customers be to recommend the bank’s online and mobile banking services?

Here again, the usual suspects occupy the top ranks: Monzo with 89% of customers likely to recommend it, and Starling bank (88%) close on its heels. Metro Bank, the embattled retail and commercial bank which nonetheless seems to retain customer loyalty, took third place (85%).

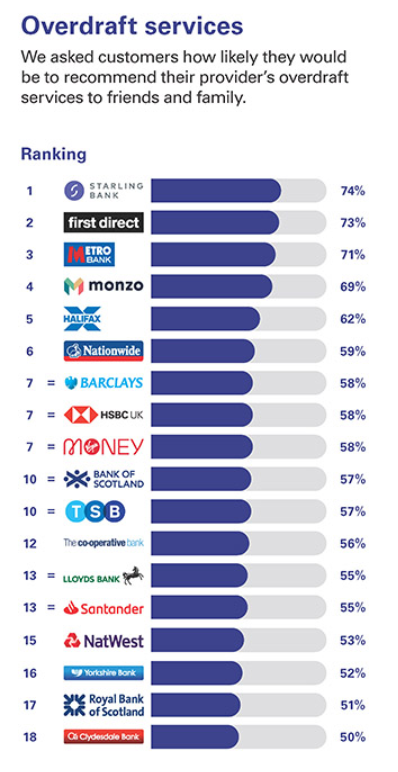

Overdraft services

How likely would customers be to recommend the bank’s overdraft services?

Once more, the top three are Starling Bank (74%), first direct (73%), and Metro Bank (71%).

Services in branches

How likely would customers be to recommend the bank’s branch services?

On this score, there are some changes in the top slots. Metro is top ranked (84%), and Nationwide (77%) is second, having moved up from last year’s third place. Money (74%) comes third.

It’s worth noting here that first direct, Monzo, Starling Bank, and Tesco Bank do not operate a branch network.

In total, 19,141 bank customers were surveyed in Great Britain.

Northern Ireland

Participating providers: AIB, Bank of Ireland UK, Barclays, Danske Bank, HSBC UK, Halifax, Nationwide, Santander, Ulster Bank.

Overall service quality

Customers were asked how likely they would be to recommend their personal current account providers to friends and family.

Nationwide, the world’s largest building society, takes first overall place with 76% of customers willing to endorse it. HSBC UK, a bank that has been dogged by below-average customer satisfaction scores for a good number of years, ties with Barclays at 68%.

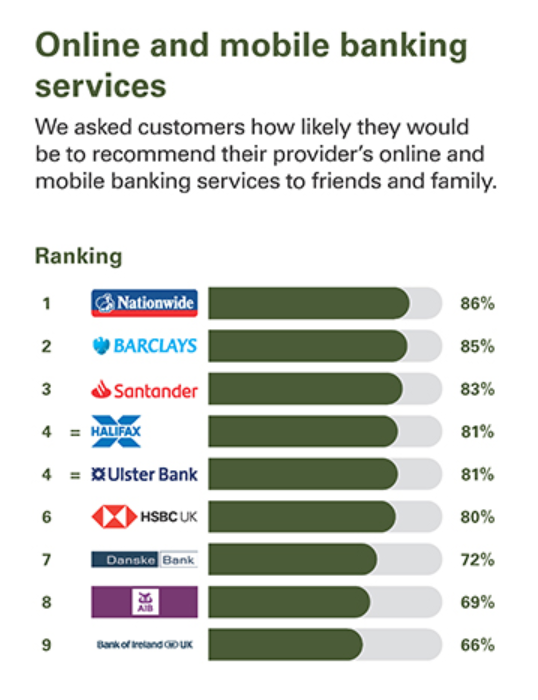

Online and mobile banking services

How likely would customers be to recommend the bank’s online and mobile banking services?

Again, Nationwide leads (86%), followed closely by Barclays (85%), with Santander (83%) in third place.

Overdraft services

How likely would customers be to recommend the bank’s overdraft services?

HSBC UK take first price with 70% of approving customers, followed by Barclays (65%) and Nationwide (63).

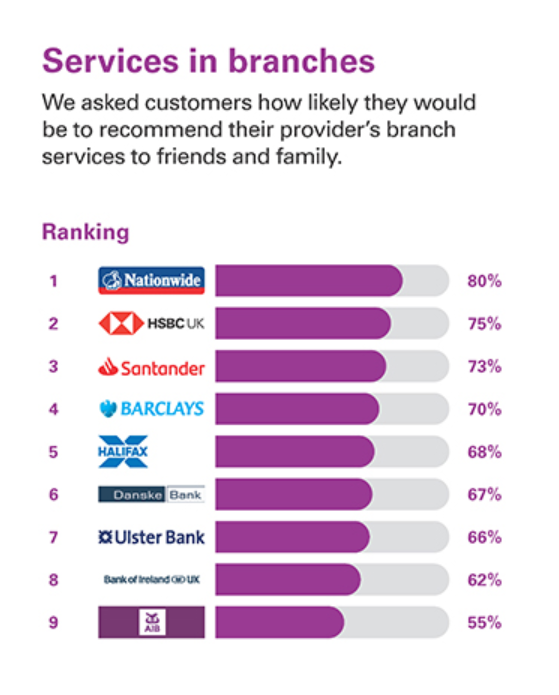

Services in Branches

How likely would customers be to recommend the bank’s branch services?

Nationwide leads with 80% of customers loving its branch services. HSBC UK (75%) and Santander (73%) take second and third places.

In total, 4,545 people were surveyed in Northern Ireland.

“Customer attitudes have shifted”

Wayne Johnson, CEO, Encompass Corporation comments:

“These new findings illustrate that consumer attitudes have shifted in regard to banking, with more people than ever recognising the benefits of a bank that prioritises digital services.”

Johnson argues that fintech and online services have taken on greater importance throughout the COVID-19 crisis, “as remote and mobile access shifts from convenience to necessity.”

Banks that are still trying to operate legacy systems, he said, must understand that they have a responsibility to provide this seamless experience at all times, “which has been the catalyst for many pushing their digital transformation initiatives to the top of the agenda.”

Today marks the fifth publication over 3 years of the service quality league table of personal and business current account providers, put in place following the Competition and Markets Authority’s (CMA) market investigation into retail banking in 2016.

For the first time these new publications include the service quality rankings for the new digital banks Monzo and Starling and for Virgin Money.

Results are updated every six months, in August and February.