US branch closures are accelerating with 4% of outlets closing in the past year at the country’s largest retail banks.

Specifically, Wells Fargo, Chase, Bank of America and US Bank have all axed over 100 branches in the past year.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

But by international comparisons, the US remains over-branched and there remains scope for further large scale branch closures.

As US branch closures slowly ramp up, Capital One is the most aggressive in terms of shrinking its network.

In the 12 months to end June, Capital One closed one in five of its branches. The Capital One branch network is down to 488 outlets from 604 branches at end June 2018.

Consequently, Capital One has closed over 50% of its branches since its network peaked at 991 outlets in 2010.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAt the end of June 2019 there are 80,375 FDIC-insured commercial bank branches in the US.

FDIC-insured commercial bank branch numbers across the US peaked at 88,056 units in June 2009.

So in the past 10 years there is a net reduction of 7,681 outlets or 9% of branches.

US branch closures ramp up but is the US still over-branched?

Such figures suggest that the US remains significantly over-branched by international comparison.

Take the UK as an example.

There remain twice as many branches per head in the US compared to the UK.

More than 80,000 branches to serve a US population of 326 million equal 24.6 branches per 100,000 people.

By contrast with the UK, 7,500 branches serve 66 million equalling 11.3 branches per 100,000 people.

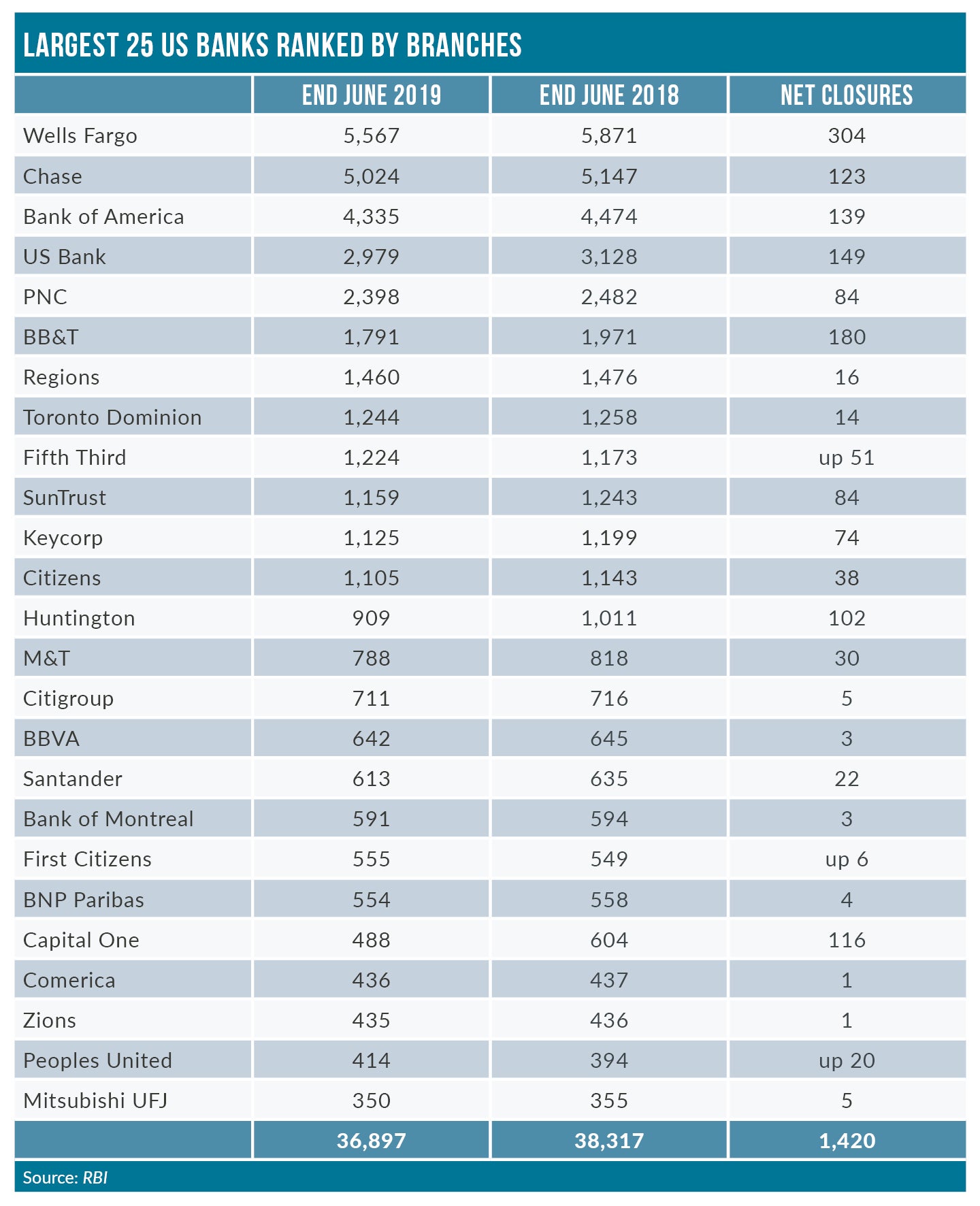

Together, the largest 25 US retail banks by branches (listed below) account for around 37,000 outlets – almost one half of all US branches.

In all, there are now 4,630 FDIC-insured commercial banks in the US, down by over 200 in the past year.

The number has reduced by one-third since the financial crisis. For example, in 2009 there were a total of 6,994 FDIC-insured commercial banks in the US.

Further back, in June 1994 there was more than 10,700 FDIC-insured commercial banks in the US.

US branch closures – 715 outlets closed by big 4

Wells Fargo remains the largest US bank ranked by branches with 5,567 branches. In the year to end June, Wells Fargo closed over 300, about 5% of its branches.

Wells Fargo branch network peaked at 6,795 outlets in 2009 following its acquisition of Wachovia and its 3,363 branches.

Of the major banks, Chase remains the most enthusiastic advocate of the branch channel at least in terms of numbers.

In 2008, as the banking crisis peaked, Chase operated 3,195 units. The acquisition of the failed Washington Mutual added 2,213 units with Chase ending 2010 with just over 5,250 units.

It then bucked the trend towards shrinking branch numbers by adding to its branch channel. The Chase branch network peaked at 5,697 outlets as recently as 2013.

In the past six years Chase branch numbers are down by 10% to 5,024 at the end of June 2019.

At the same time as retiring branches in markets where it is strong, Chase is expanding in select markets.

In particular, Chase is expanding into nine key markets, growing its network in Greater Washington, Philadelphia and Boston.

Chase also plans to add branches in new locations close to large universities. These include Auburn University in Auburn, Alabama and the University of Nebraska in Lincoln, Nebraska. Chase also plans to expand into these states more broadly in 2020.

US branch closures – 1 in 3 Bank of America units axed since crisis

By contrast Bank of America’s branch network has reduced each year since peaking at 6,238 in 2009.

In the past ten years, Bank of America has axed almost one in three of its branches. Bank of America ends the first half of 2019 with 4,335 branches down by a net 139 in the past year.

Citi was one of the first US banks to prioritise rightsizing of its branch network. As a result, it has already completed much of the heavy lifting. In the past two years, the Citi US branch network is down by only seven units.

The Citi branch network peaked at 1,079 units in 2008. Since then more than one in three Citi branches have closed, leaving just 711 at the end of June 2019.

Citi is now only the 15th-largest bank by branches but retains its spot as the fourth-largest US bank as measured by deposits.

US branch closures: regional lenders’ shrinking estate

In the 12 months to end June 2019 PNC closed a net 84 outlets. PNC ends the first half of 2019 with 2,398 branches. More than one in five PNC outlets has closed since the network peaked at 3,044 in 2012.

Likewise, SunTrust is shrinking its network aggressively. In the past 12 months, SunTrust closed 84 outlets, almost 7% of its branch estate.

SunTrust has now closed one in three of its outlets since its branch estate peaked at 1,759 units in 2008.

Meantime, Citizens branch network is down by 30% since peaking at 1,654 a decade ago. Citizens ends the first half of 2019 with a network of 1,105 down 38 in the past year.

By contrast, Toronto Dominion’s branch network is relatively unchanged. TD ends the first half with 1,244 outlets, down by little over 100 since numbers peaked at 1,336 in 2013.

Other major international players have been relatively slow to shrink their branch networks.

BBVA closed only three branches in the year to end June and now runs 642 outlets.

Only 15% of BBVA branches have closed since its US branch network peaked at 759 in 2010.

Likewise, Bank of Montreal has closed around 15% of its branches since its network peaked at 708 in 2012.

Santander has been slightly more aggressive with one in four of its branches closing since the crisis.

The Santander US branch network peaked at 807 in 2017. Santander ends the first half with 613 outlets, down 22 on the year.