The average 30-year mortgage rate in the US reached 7.79% in October, the highest level since November 2000. This is forcing homebuyers and their lenders to get creative when it comes to finding ways to finance their home. According to the JD Power 2023 US Mortgage Origination Satisfaction Study, many lenders have had to pivot in the past year to meet the needs of a purchase-heavy market. The survey concludes that they have successfully delivered on key elements of the borrowing experience. This results in significantly higher overall customer satisfaction.

But this improved service level could be hard for most to maintain. Aggressive cost-cutting is starting to take a toll and market conditions are unlikely to improve in the foreseeable future.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“Two years ago, the mortgage market was an ultra-low-rate goldmine. Lenders were making big profits and the primary challenge was keeping up with demand,” said Craig Martin, executive managing director and global head of wealth and lending intelligence at JD Power.

“It’s the opposite today with high rates. A lack of affordable homes leads to a limited number of eligible borrowers. To effectively compete in the future, lenders need to set themselves apart by focusing on addressing customers’ unique challenges and meeting their needs rather than selling a product.”

JD Power 2023 US Mortgage Origination Satisfaction Study takeaways

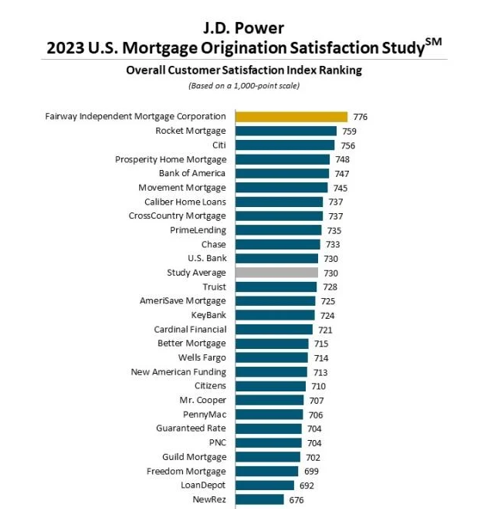

Overall satisfaction is rising despite record high rates. Overall customer satisfaction with mortgage lenders is 730 (on a 1,000-point scale), up 14 points from a year ago. This is despite the average mortgage rate climbing to its highest level in 23 years and overall lending volume declining.

Almost one-third (31%) of mortgage customers say they selected their lender solely because they offered the lowest interest rate. More than two-thirds (69%) chose lenders for other reasons. Examples include personalised service and ability to help navigate the loan market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataLenders are engaging earlier but more is wanted. Many lenders are finding that by engaging with borrowers earlier in their shopping journey, they can retain those customers throughout the process. Overall, 38% of mortgage customers say they started working with a lender when they first thought about buying. Borrowers who say their loan rep should have been more involved rises to 40% from just 29% a year ago.

First-time homebuyers are struggling

While overall customer satisfaction with the lending process increases this year, the increase is driven primarily by repeat buyers. Overall satisfaction among first-time homebuyers, however, is down significantly. This reflects the complex lending environment and considerable challenges customers are facing.

“The value equation for mortgage originators has shifted from instant approvals and lightning-fast processing to helpful advice and creative problem solving,” added Bruce Gehrke, senior director of wealth and lending intelligence at JD Power. “Lenders that manage this transition well have a great opportunity to build customer goodwill. And limit defection by showing customers they understand their unique needs and the challenges of the current market.”

Study Ranking

Fairway Independent Mortgage Corporation ranks highest in mortgage origination satisfaction, with a score of 776. Rocket Mortgage (759) ranks second and Citi (756) ranks third. Prosperity Home Mortgages (748) and Bank of America (747) round off the top five.