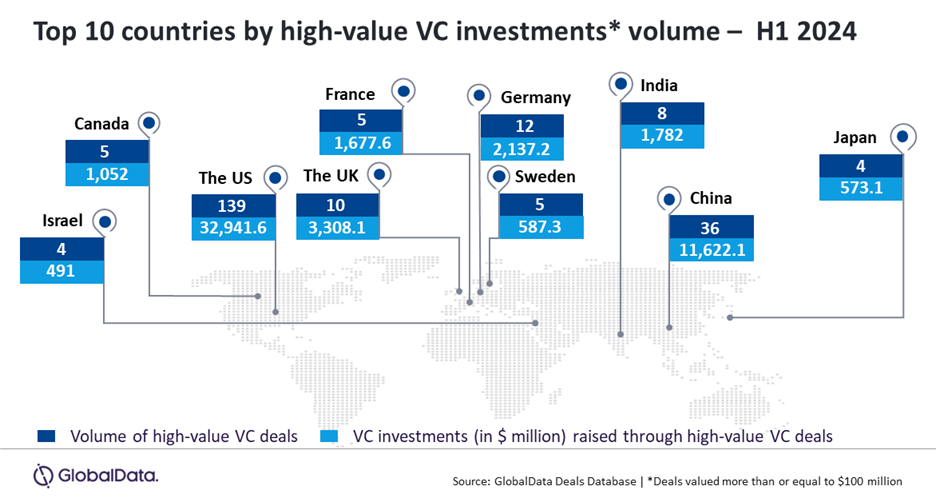

The US was home to the majority of the high-value venture capital (VC) investments globally, accounting for 54.7% and 55% in terms of deal volume and value, during the first half (H1) of 2024. This trend reflects the country’s strong innovation ecosystem in shaping the competitive investment landscape, reveals, GlobalData, publisher of RBI.

An analysis of GlobalData’s Deals Database revealed that the US is distantly followed by China and these two countries collectively accounted for more than two-thirds of the total high-value VC investments volume and value.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “The US continues to dominate and outpace peer countries by a significant margin in terms of both volume and value of high-value VC deals while China also remains a significant market for VC funding activity. The significance of the US and China can be understood from the fact these are only two markets with double-digit market shares.”

The US and China collectively accounted for 68.9% share of the total number of high-value VC investments announced globally during H1 2024, whereas their share of the corresponding funding value stood at 74.3%.

The US witnessed the announcement of 139 high-value VC deals worth $32.9bn during H1 2024

Meanwhile, a total of 36 high-value VC deals worth $11.6bn were announced in China during the review period amounting to 14.2% and 19.4% share in terms of deal volume and value, respectively.

Bose adds: “Of the top 10 countries by volume of high-value VC deals in H1 2024, four are from Europe, three from Asia-Pacific region, two from North America and one the from Middle East and African region.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe US and China were followed by Germany, the UK, India, France, Canada, Sweden, Japan and Israel.

Bose concludes: “The data underscores a clear dominance of the US, highlighting its appeal for innovation. While China remains a formidable player, together these two nations command an impressive share of the global VC landscape. The diverse global presence of other top countries highlights a competitive, yet US-centric, venture capital market, reflecting both the opportunities and challenges faced by emerging markets striving for a larger stake.”