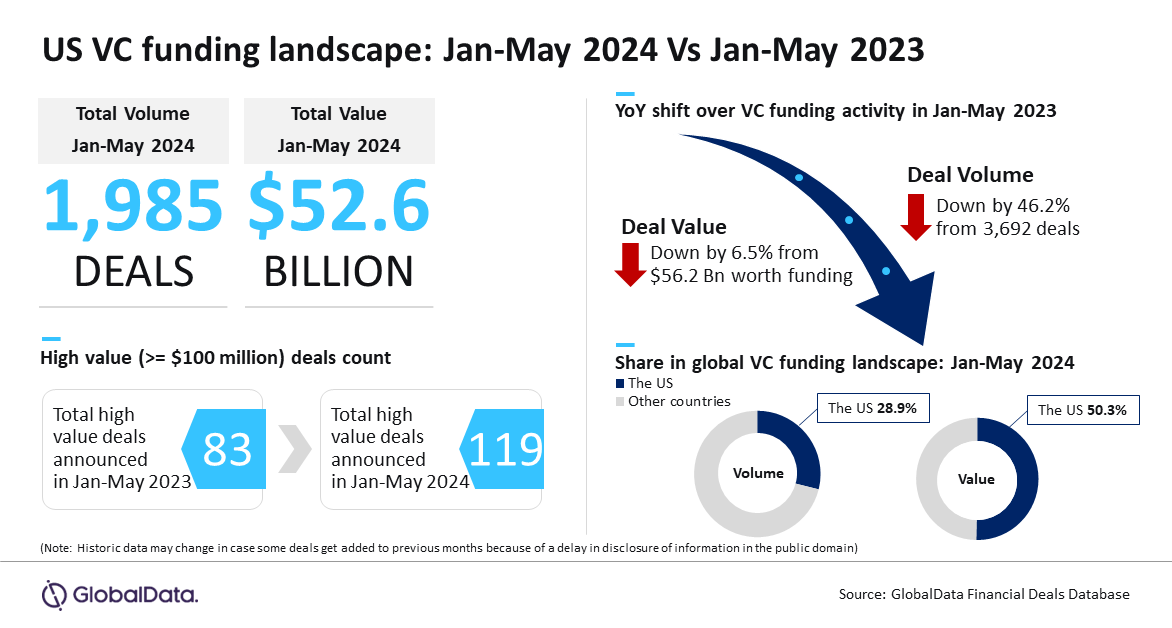

US startups secured $52.6bn venture capital (VC) funding through 1,985 deals in the first five months of 2024. Despite a significant year-on-year (y-o-y) decline in deal volume, the funding value dropped only slightly, highlighting a trend of larger investments in fewer deals. Notably, May saw a surge with four billion-dollar deals, emphasising cautious yet substantial investments, according to GlobalData, publishers of RBI.

GlobalData Deals Database

An analysis of GlobalData’s Deals Database revealed that both the volume and value of VC deals showcased y-o-y decline during the first five months of 2024. VC deals volume declined by 46.2% y-o-y compared to the announcement of 3,692 during January-May 2023. Meanwhile, the corresponding disclosed funding value fell by 6.5% y-o-y compared to $56.2bn raised during January-May 2023.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Aurojyoti Bose, Lead Analyst at GlobalData, said: “The modest 6.5% decline in funding value, despite a nearly 50% drop in deal volume, indicates a positive trend. Venture capital firms are investing substantial amounts in fewer deals, demonstrating a willingness to make significant bets while exercising caution in evaluating startups.”

5 billion-dollar deals

In fact, the US saw the announcement of five billion-dollar deals (≥ $1bn) during the first five months of 2024, of which four were announced in May itself. The deals include $6bn raised by X.AI, $1.1bn raised by CoreWeave, $1 bn raised by Scale AI, $1bn by Wiz and $1bn by Xaira Therapeutics.

Bose adds: “It is noteworthy that the year-on-year decline in value was 28.7% from January to April 2024. However, a strong performance in a single month reduced the year-on-year decline to 6.5% for January to May 2024.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMeanwhile, the US continues to dominate the global VC funding landscape, holding the highest share in both deal volume and value. From January to May 2024, it accounted for 28.9% of the total global VC deals volume and 50.3% of the disclosed funding value.

Bose concluded: “The dynamics of VC funding in the US reflect a strategic pivot towards concentrated high-impact investments. The ability to maintain funding stability amidst a volatile market speaks volumes about investor confidence in the US startup ecosystem.”