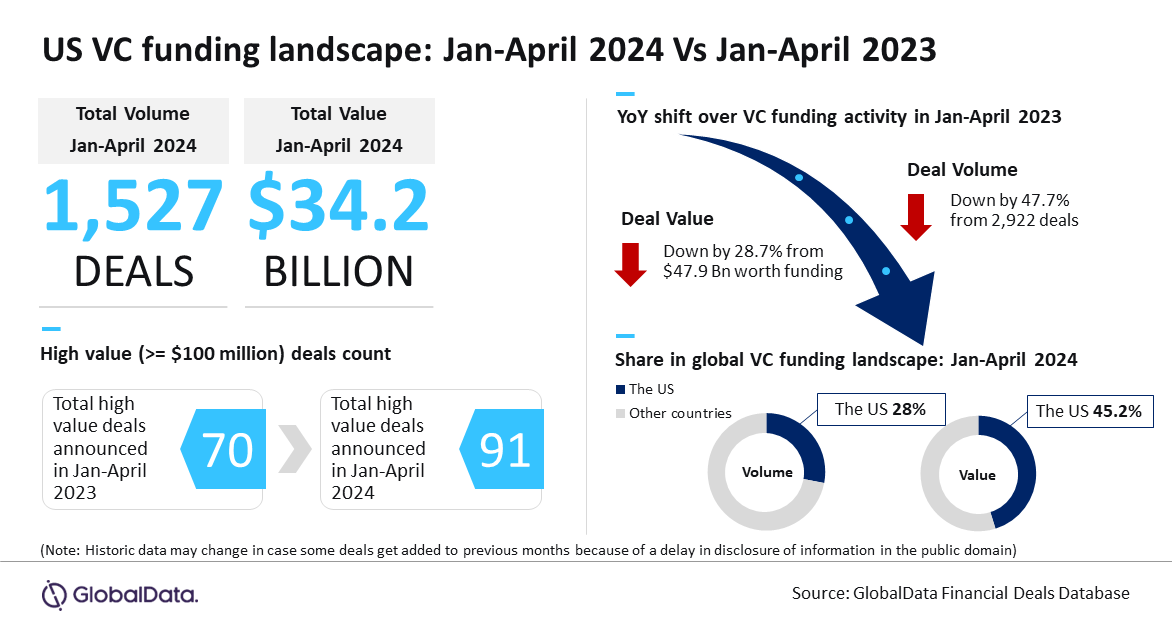

Venture capital (VC) funding activity by the US startups experienced a year-on-year (y-o-y) decline both in terms of deals volume and value during January-April 2024. A total of 1,527 VC deals of worth $34.2bn were announced in the US during January-April 2024. This represents a y-o-y decline of 47.7% in terms of deals volume and 28.7% in terms of value, according to GlobalData, publishers of RBI.

GlobalData Deals Database

An analysis of GlobalData’s Deals Database revealed that a total of 2,922 VC funding deals were announced in the US during January-April 2023 while the total disclosed funding value of these stood at $47.9bn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The US accounted for 28% share of the total number of VC funding deals announced globally during January-April 2024 while its share of the corresponding disclosed funding value stood at 45.2%.

Bose added: “Despite the market volatility, the US’ attractiveness continues to remain among VC investors, which is also evident from the fact that it accounted for close to half of total venture capital raised globally during the review period.”

Some of the notable VC funding deals announced in the US during January-April 2024 include $1bn raised by Xaira Therapeutics, $700m raised by Wonder, $675m raised by Figure AI, $520m raised by Nexamp and $400m raised by Mirador Therapeutics.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData