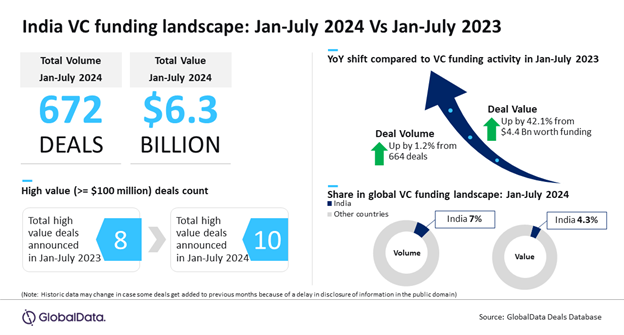

India’s startup ecosystem saw a significant surge in venture capital (VC) funding during January-July 2024, with a total of 672 deals raising $6.3bn. This represents a massive 42.1% year-on-year (YoY) increase in funding value, despite a modest 1.2% rise in deal volume. The spike in funding highlights investor confidence in India’s promising startups, even amid cautious global market conditions, according to GlobalData, publishers of RBI.

An analysis of GlobalData’s Deals Database revealed that India witnessed the announcement of a total of 664 VC deals with disclosed funding value worth of $4.4bn during January-July 2023.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “The massive jump in funding value, despite a modest 1.2% growth in deal volume, can be attributed to some of the big-ticket deals announced during the review period. This also proves that even though VC investors remain cautious there is no dearth of money for promising startups.”

Some of the notable venture funding deals announced in India during January-July 2024

This includes $665m worth funding raised by Zepto, $300m raised by Meesho, $216m worth funding raised by PharmEasy, $150m worth funding raised by Radiance, $148m worth funding raised by Kogta Financial and $120m worth funding raised by Rapido.

Bose adds: “India, apart from being a key Asia-Pacific (APAC) market for VC funding activity standing just next to China, is also one of the top five markets globally in terms of both VC funding deal volume and value.”

India accounted for 7% share of the total number of VC deals announced globally during January-July 2024 while its share of the corresponding disclosed funding value stood at 4.3%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBose concludes: “Despite global economic uncertainties, India remains a pivotal market for VC activity, driven by a robust pipeline of promising startups that continue to attract significant capital. This trend reinforces India’s position as a critical player in the global venture ecosystem, demonstrating resilience and growth even amid cautious investment sentiment.”