Liu Liange, the former chair of the Bank of China has been arrested due to suspicion of bribery and giving out illegal loans. Liange was Chairman of the bank from 2019 to 2023, leaving the position in March this year. An investigation into his alleged corruption was announced weeks after the resignation

This comes as several high-ranking figures in China banking have faced arrest for corruption. This is part of President Xi Jinping’s anti-corruption campaign. Earlier this year Wang Bin, the former chairman of China Life Insurance, was sentenced to live imprisonment without parole. It can be assumed that there could be similar arrests moving forward, with the investigation into banking corruption in China showing no signs of slowing down. But this certainly appears to be the biggest arrest made so far.

The arrest comes a week after he was expelled from China’s Communist Party. This was following accusations of wrongdoing and suspicion that Liange had committed a range of illicit activities which led to significant financial risks.

Twitter reacts to the arrest

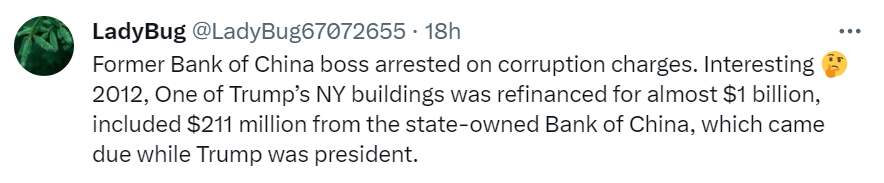

While Twitter is blocked in China, the story is still a big talking point on the site. Users looked at the global impact of the arrest, with one user suggesting that it “Might be the moment for the city of London to ends it’s partnership with the Bank of China.” On the whole there is praise for President Xi Jinping and his anti-corruption campaign

You will do well to find any topic being discussed on social media and not find a comment relating it to Donald Trump. This is no different. One user pointed out that the Bank of China contributed $211m towards the refinancing of one of Donald Trump’s buildings in 2012. The Bank of China were previously tenants at Trump Tower.

As the case unfolds more revelations are expected, most notably the specific accusations towards Liange. Further arrests will be met with a similar amount of attention, and most likely, a declining amount of surprise.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.