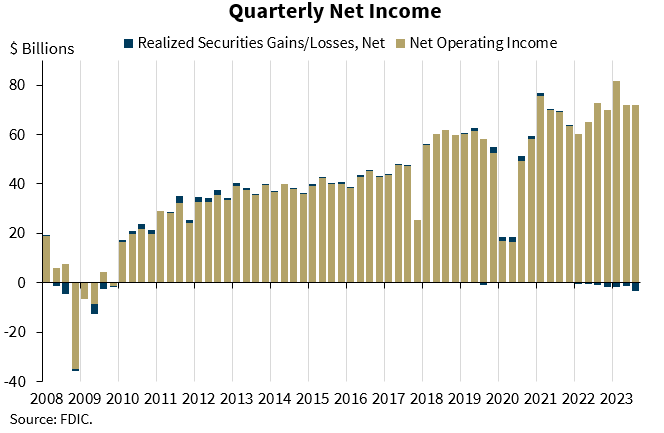

Third quarter net profits are down across the US banking sector, driven by lower non-interest income. Specifically, non-interest income is down by 5.2% quarter-on-quarter.

Higher realised losses (up $3.0bn) on securities also contribute to the decline.

In the third quarter of 2022, FDIC insured institutions reported net income of $71.7bn. For the quarter to end October 2023, net income falls by 4.6% to $68.4bn.

Compared with the prior quarter, the figure drops by 3.4%.

US Banks results Q3 2023 key takeaways

The net interest margin increases from the prior quarter to 3.30%. This represents a 16-basis point rise from the year ago quarter (Q3 2022: 3.14%).

Though deposit costs increased faster than loan yields over the quarter, the cost of non-deposit liabilities was stable. This results in the increased net interest margin.

Loan balances increase from last quarter and the year ago quarter. Total loan and lease balances increase by 0.4% quarter-on-quarter.

Credit card loans drive increase in lending, deposits again decline

An increase in credit card loans (up 2.5%) and one-to-four family residential mortgages (up 0.9%) drove loan growth. Compared with the year ago quarter, total loan and lease balances increase by 2.9%. This increase is led by credit card loans (up 12.7%). One-to-four family residential loans rise by 4.7% y-o-y. Meantime, non-farm non-residential commercial real estate loans are up by 3.3%.

But total deposits decline for the sixth consecutive quarter. Total deposits of $18.6trn are down by 0.5% quarter-on-quarter. Interest bearing deposits increase, while non-interest-bearing deposits fell. Estimated insured deposits (up 0.1%) increased modestly during the quarter.

Year-on-year, total deposits are down by 3.9% from $19.36trn.

Provisions for credit losses totalled $19.5bn in third quarter 2023, down $1.9bn from the previous quarter but up $4.9bn from a year ago.

Industry remains well capitalised: FDIC

FDIC chair Martin Gruenberg, said: “The banking industry continued to show resilience in the third quarter. Net income remained high. Overall asset quality metrics remained favourable and the industry remained well capitalised. The banking industry still faces significant downside risks from the continued effects of inflation, rising market interest rates, and geopolitical uncertainty. In addition, deterioration in the industry’s commercial real estate portfolio is beginning to materialise in office properties. These issues, together with funding and earnings pressures, will remain matters of ongoing supervisory attention by the FDIC.”