Twice a year, the CMA releases its independent survey of the largest UK retail banks. And regular as clockwork, the same brands are named and shamed.

Virgin Money and RBS, again, are at the bottom of the poll for overall service quality. The survey has been running since August 2018 and is updated each February and August. And so, the latest results represent the 12th such set of results.

In the very first set of results in August, Clydesdale Bank (now re-branded as Virgin Money) and RBS ranked joint bottom, with 49%.

RBS: bottom in 10 of the 12 surveys released since 2018

Ten surveys later, the same two banks rank joint bottom of the 16 brands, with just a 48% approval rating. RBS has not scored above 48% in any of the 12 surveys to date. It has ranked plumb last in 10 of the 12 polls, its best performances being second bottom in August 2020 and February 2022.

Virgin Money has ranked as high as 11th equal in February 2020 with an overall approval rating of 56%. It last scored above 50% in February 2021 with 54%.

Virgin Money: ranked second worst in four of the last five surveys

Since then, Virgin Money has ranked 15th, 15th, 15th, 14th and 15th in five subsequent surveys.

The CMA survey is part of a regulatory requirement. An independent survey is conducted by Ipsos. Customers of each of the 16 largest personal current account providers are asked if they would recommend their provider to friends and family.

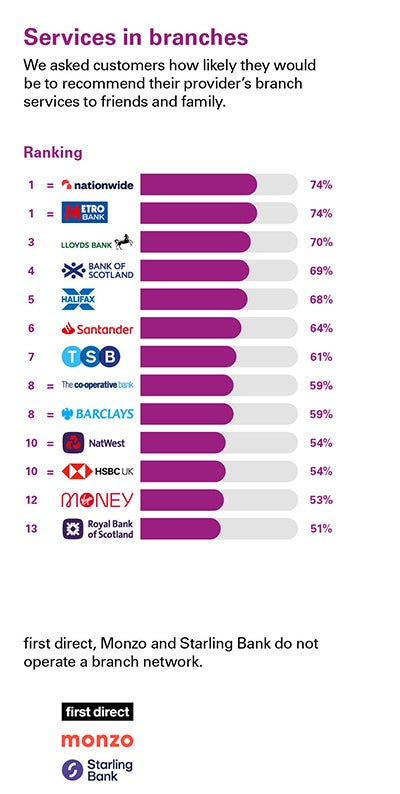

Current account customers are also asked how likely they would be to recommend their provider’s online and mobile banking services, services in branches and overdraft services to friends and family.

Monzo, Starling run rings around established rivals for 8 successive surveys

At the top of the latest survey, Monzo (80%) ranks first ahead of Starling (78%) and First Direct (77%). Nationwide (69%), Halifax and Metro Bank follow, each with 66%. Monzo and Starling first featured in the surveys in August 2020. Since then, Monzo and Starling have run rings around their more established rivals.

In the eight surveys since August 2020, Monzo has ranked top on five occasions and joint top in the other three surveys. In the same eight surveys since August 2020, Starling Bank’s worst performance was third in February 2021. It has ranked joint top on three occasions and second on four occasions.

First Direct, Metro Bank and Nationwide: consistent strong performers

Of the established brands, Nationwide ranked third in the first four surveys. Since then, it has always ranked fifth, with one fourth place in August 2023. First Direct ranked top in the first survey in August 2018. It last ranked top in February 2020. Since then, it has ranked second on two occasions and 3rd on five occasions. Its worst ranking is fourth, in the latest February 2024 survey. The latest survey also represents the weakest performance of the 12 to date for Metro Bank, in fifth place. Metro Bank ranked fourth in every survey from August 2020 to August 2023. It topped the survey in each of the 2019 surveys and ranked second in August 2018 and February 2020.

Service quality in branches: 12 top spots in a row for Metro Bank

A separate survey asks customers how likely they would be to recommend their provider’s branch services to friends and family. In the first 11 surveys from August 2018 to August 2023, Metro Bank ranked top in this survey. In the latest survey, Metro Bank ranks joint top with Nationwide. In all 12 surveys to date, Nationwide ranks in the top three in this category, except in August 2023, when it ranked fourth.