Retail deposits are benefitting from a flight to safety, notwithstanding record-low levels of interest rates, with the European Central Bank highlighting the growth in bank deposits as a reason for caution on the speed of any economic recovery, writes Douglas Blakey

Household savings are growing at record levels across Europe, hitting €7.3trn in May, up by €214bn in just three months. According to the European Central Bank, household savings in the eurozone soared by over 130% year-over-year in March and April.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

For example, in Italy, bank deposits grew in May by 5.7% on an annual basis, versus. 4.3% in April.

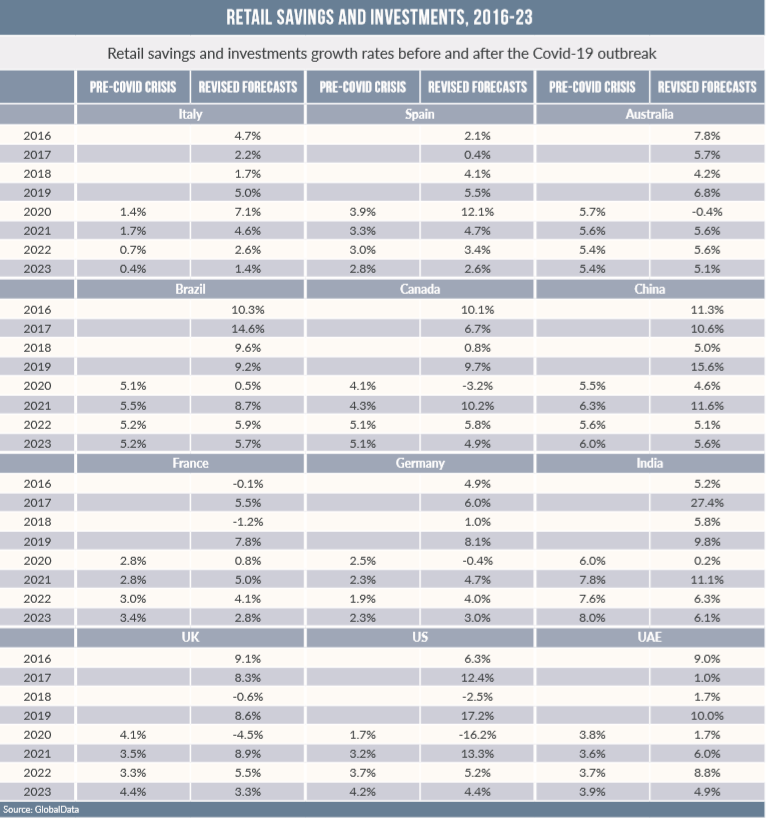

Meantime, in Spain, GlobalData, publishers of RBI forecast that deposit holdings will grow by 12.1% in 2020 up from a previous forecast of 3.9%. And in France, bank deposits and cash holdings held by households increased in April 2020 to reach €26.6bn – up 35.7% from March 2020. When combined with increased risk aversion, this is expected to see retail deposit holdings expand by 6.8% over the course of the year, as opposed to the 3.6% initially forecast before the onset of Covid-19.

If anything, the surge in deposits is even more pronounced in the US with the FDIC reporting record deposits growth. In April, deposits grew by $865bn, more than the previous record for an entire year.

The US reported a record high personal savings rate in April of 33%, up from 12.7% in March.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBank of America, with a market share of more than 10% of retail deposits, reports that current accounts have increased balances of around one-third compared with the time of the pandemic kicking off.

But the impact on equities and mutual funds will be markedly down. US portfolios allocate an average of 70% to equities and mutual funds – the most of any country. GlobalData forecasts the US’s retail savings and investments to contract in 2020, driven by sinking equity and fund prices. GlobalData forecasts that retail equity and mutual fund balances will decrease by 32.0% and 21.4% respectively in 2020.

Meanwhile, deposit and bond holdings are set to benefit from the flight to safety away from risk with forecast balances set to increase by 8.0% and 11.3% respectively, in line with behaviour from past crises.

Canada: retail deposits surge

In Canada, retail deposits are also forecast to surge as consumers go into capital preservation mode during the crisis and the resulting recession. In line with the 2008 crisis, deposit growth of up to 12% in 2020 is forecast. However, overall retail savings and investments are expected to decline by 3.2% in 2020 as the mutual fund and equity holdings of retail investors drop in line with other mature markets.

As one of the few countries to have significant direct retail bond holdings, the performance of bonds will also mitigate some of the negative experience in Canadian investments in 2020. Bond holdings are expected to be boosted by 4.3% in 2020, the strongest showing since 2015.

Australia has dealt with the pandemic better than most countries but the market here is also taking a hit.

GlobalData had forecast that retail savings and investments were poised to grow by 5.7% in 2020. However, due to the ongoing disruptions to economic activity and resulting uncertainty, the market is now forecast to contract by 0.4% during the year.

Deposits are the only assets class in the retail mix forecast to experience higher growth in 2020 compared to pre-Covid-19 forecasts, as investors looking for the safety they provide. According to the Australian Bureau of Statistics, the household savings ratio increased to 5.5% in Q1 2020, up from 3.5% in December 2019. Deposits’ proportion of overall holdings is set to climb from 51.0% at the end of 2019 to 54.4% by 2024.

China deposits growth muted

In China, the retail savings and investment market is forecast to grow by just 4.6% in 2020, its worst performance since the global financial crisis over a decade ago.

Unlike more developed markets, the government support to households during the crisis was relatively modest. As a result, there is unlikely to be strong deposit growth, with an increase of only 11.5% expected compared to the pre-Covid prediction of 9.5%.

As volatility is not expected to subside in the near future, investors are expected to stay away from risk assets for now. GlobalData now forecasts retail equity and mutual fund holdings to decrease by 19.1% and 14.4%, respectively, in 2020.

In India, retail savings and investments are forecast to grow by a mere 0.2% over the course of 2020 as economic productivity has plummeted thanks to the impact of the pandemic. Retail equity and mutual fund holdings are expected to take the brunt of the economy’s slowdown, with respective declines of 17.5% and 12.2% anticipated.

Retail deposits make up the majority of retail holdings, albeit a relatively low proportion for an emerging economy (54.9% at the end of 2019). Retail deposits will, as in other markets, benefit from the flight to safety, with growth now forecast of 12.5% compared to the pre-Covid forecast of 4.3%.

But in the UAE, the market is suffering the double whammy of the effects of the pandemic and the oil price collapse. GlobalData now forecasts retail savings and investments holdings to expand by only 1.7% during the year, a downward revision from 3.8%.