Open X is a concept that the financial services industry has been facing for some time. With growing consumer expectations and the pressure for digital services in a Covid-19 world, that concept is only set to accelerate. Evie Rusman reports

It is no secret that these days, consumers have high expectations when it comes to customer service. More and more, consumers are getting used to personalised services from challengers like Monzo and Starling, who leverage consumer data.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

According to the World Fintech Report 2020, written by Capgemini and Efma, now is the time for traditional incumbents to get on board with the Open X era – which encourages fintechs and banks to work together to create a unique, personalised service for consumers.

Speaking to RBI, Elias Ghanem, global head of market intelligence at Capgemini, discusses how banks need to adapt their services in order to remain relevant.

“The key message is that fintech is here to stay,” he says. “Previously, we said that fintechs were only disrupting the market, but now we can see they are solid and are building a good function into the market. Therefore, banks must board the last train to relevancy, and we call it the Open X Express. Increasingly, there is a disconnect between what the banks are doing and what consumers are looking for. Open X is a new opportunity for banks and fintechs to work together and close this gap.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWhat is Open X? Maybe box out?

Open X looks at four fundamental shifts in the sector:

- A move away from products to an emphasis on customer experience;

- Less emphasis on assets and more on data;

- Shared access instead of ownership, and

- Partnering rather than buying or building.

The argument is that banks will need to integrate with other players to provide a seamless customer experience. Vice Versa, fintechs need to collaborate with traditional incumbents as they do not tend to have the size and scale of operation required.

Examples of fintechs and incumbents working together include N26 and TransferWise. The Berlin-based challenger partnered with London-based TransferWise to help N26 customers save forex fees when making payments in foreign currencies.

In addition, Germany’s Commerzbank collaborated with IDnow, a late-stage scale up that uses machine-learning to verify its customers’ identities via video on a smartphone or computer. This resulted in a 50% conversion rate, and 30% of Commerzbank customers verifying their identity through IDnow.

Customer experience

When it comes to personal banking, Generation Z customers, in particular, demand hyper-personalised services that complement their digital lifestyle.

The report suggests that currently banks are not doing enough to retain younger, newer customers, who crave real-time services.

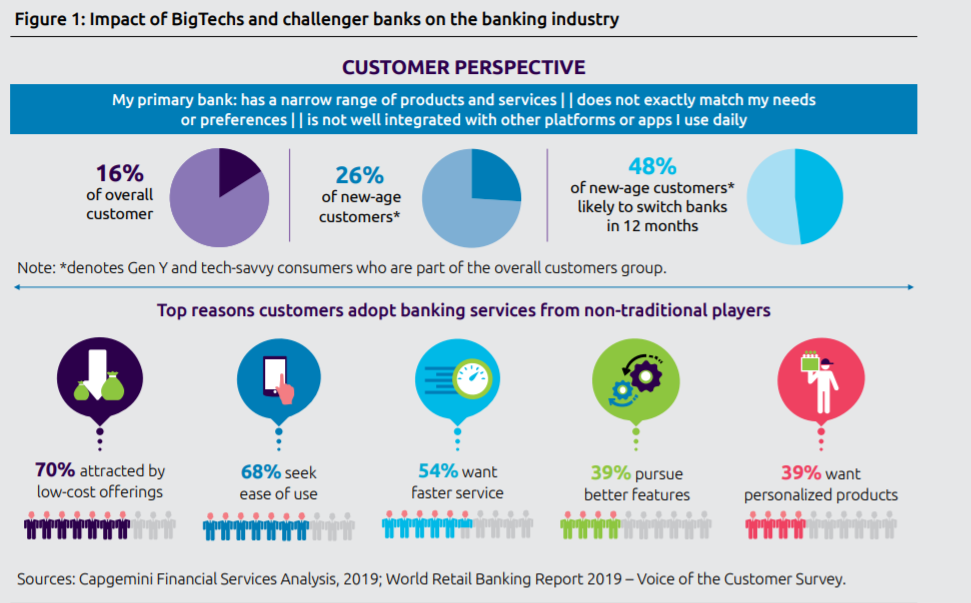

Ghanem adds: “We asked consumers to tell us how they perceive traditional banks versus new players. Unfortunately, 15% of consumers told us that their primary bank has a narrow range of services, does not match their needs or preferences, and does not integrate well with other platforms they use. The scarier part is that nearly half of new-age customers said they were likely to switch banks in the next 12 months.”

In addition, the report argues that fintechs are maturing and rapidly increasing their offerings, market presence, and customer base. Why so much success? According to the report, their ability to fuse technology expertise with an obsessive customer focus is enhancing fintech attractiveness.

Therefore, Capgemini recommends that banks deploy fintech capabilities across their business value chain as this will enable seamless data sharing from the front to the middle and back offices. Meanwhile, it will transform back-end operations, helping to connect with third-party partners.

“Fintechs are gaining traction and are changing the customer mindset,” Ghanem adds. “That’s why banks need to act now and work with fintechs – these guys have the innovation that banks need. We want to tell them to believe in innovation at scale. There really is a call to action – the time is now. Banks who have a strong reputation and reach but struggle with the Open X experience, need to collaborate with the ones that can make it work.”

UK and European acceptance

Earlier this month, open banking platform Tink released a report outlining that 52% of European financial institutions are accepting of Open X and fintech collaboration.

Speaking to RBI, Rafael Plantier, Tink’s UK & Ireland country manager discusses, how Europe is approaching the Open Banking era.

“There has been a clear rise in the number of European financial institutions that feel positive towards open banking,” he says.

“With that being said, our data suggests that there are a number of institutions that don’t fully understand the true potential that it offers — something which is holding them back from making the most of the opportunity. Indeed, some financial institutions have missed a trick by approaching open banking purely as a PSD2 compliance issue, rather than a strategic initiative that concerns the broader organisation and can create value for both business and customers alike.”

According to Plantier, in order to truly succeed and reap the short and long-term benefits of open banking, financial institutions across Europe need to be savvy, nimble and open-minded, by:

- Thinking and behaving more like TPPs by making use of APIs already available — building new use cases, creating better products and services and enhancing customer experience

- Creating a clear business strategy to realise open banking’s benefits

- Forging partnerships with like-minded fintechs, that can provide the technology, expertise and vision to drive open banking value creation

“Banks are doing a good job at adapting to the current financial landscape, which is reflected by the number of open banking partnerships that financial institutions have formed with nimble fintechs to help accelerate innovation and realise their objectives,” Plantier adds. “For instance, our research found that 69% of European financial institutions have increased their number of fintech partnerships in 2019 and a further 69% indicated that establishing a partnership will be a priority for them over the next 12 months.”

Successful Fintech/Bank partnerships

According to Capgemini’s World Fintech Report successful fintech/bank partnerships are pretty rare. Why is this? The report highlights three reasons:

- Ownership dilemma: Banks approach innovation with the end goal of owning it, which limits the variety of offerings they can provide and drive customers away to other players.

- Bureaucracy: Many banks have various functional units operating in silos, and before a partnership is approved, each group must sign off. This time-consuming approach does not bode well for nimble FinTechs.

- Cost of innovation: Hindered by technology spending constraints, banks must sometimes take shortcuts and apply innovation to only a segment of the value chain, which can end up delay

Speaking on successful partnerships, Plantier adds: “There are many different types of fintech partnerships. However, there are only a small number of open banking fintech partnerships that can address large-scale open banking use cases. This is because when it comes to data protection, large institutions traditionally demand enterprise-level support, service level agreements and state-of-the-art technology. This means that before entering into a fintech partnership, financial institutions will not only assess a fintech’s technology offering, but also carefully scrutinise a potential partner’s capabilities in terms of support, security, and integrity.

“As such, fintechs need to be set up in such a way that they become adept at navigating the complex procurement processes and onboarding requirements that many banks have in place. They must be cognisant of the highly scrutinised and regulated environment in which banks operate and understand that enacting change in large organisations cannot take place overnight.

Plantier continues: With this in mind, for partnerships to be a true success they must be formed at a strategic level with strong buy-in and backing from senior executives in both businesses. They must be dedicated to creating value for customers by enabling incumbent institutions to innovate and operate as fast as a fintech in the open banking market. These kinds of high value, strategic partnerships will be vital to realising the benefits of open banking and creating both short and long term value for financial institutions.”

Impact of Covid-19

Capgemini’s World Fintech Report was produced before Covid-19 developed into a global pandemic –Ghanem highlights that it was not possible to include details surrounding the virus in the report.

Speaking to RBI, he argues that banks are beginning to show their weaknesses amid Covid-19.

“First of all, it is clear that banks have shown their disadvantages and weaknesses in terms of research channel in the Covid-19 situation,” he says. “Logically, they should be overinvesting in catching up with digital channels. The problem is that it will be quite difficult for banks to invest post-Covid as everybody is now looking to reduce costs.

“On one hand they should invest to improve their experience,” Ghanem continues. “On the other hand, they are limited due to issues surrounding cost. In addition, fintechs already offer digitisation, however, they might run out of cash as vendors are becoming more careful and less willing to invest. So on one side, we have banks that need innovation but do not have the money to invest, and on the other we have fintechs who have the solution but not the money to collaborate.

“In current circumstances, if banks collaborate with fintechs, we can turn a vicious cycle into a virtuous one where fintechs benefit from acting as providers to banks. For me, what could be seen as a lose-lose scenario, due to Covid-19, could be a win-win if both parties work together.”