Monzo, the UK digital-only bank that offers advanced mobile banking features and personal financial management tools, is looking to expand into the US. However, the success of its move hinges on how it tackles a number of different challenges, ones that it does not currently face in the UK.

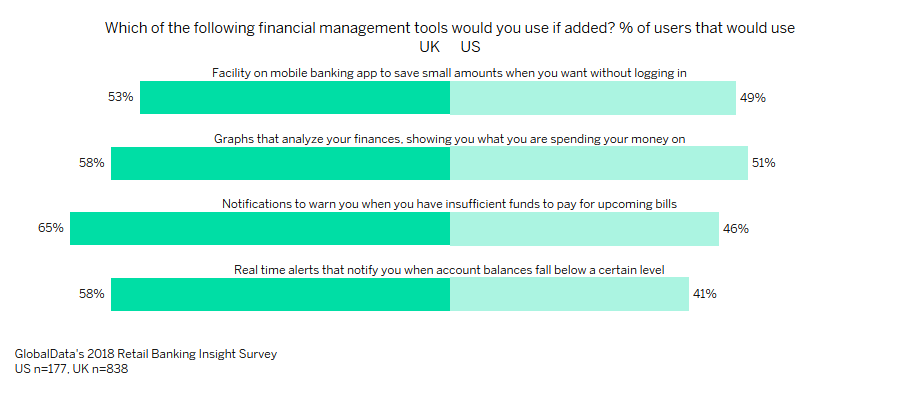

While the percentage of millennials who prefer physical banks might only be marginally higher in the US than the UK (69% compared to 67%), the level of demand west of the Atlantic for their personal financial management (PFM) tools is much lower. GlobalData’s 2018 Retail Banking Insight Survey showcased this lower demand for PFMs such as graphs that analyze a user’s finances and the provision of real-time alerts – two areas that Monzo specializes in.

Monzo is an exciting new brand in the market that offers an excellent digital service – but these factors were the least popular among US millennials who were asked what they look for in a financial services company.

Due to the low demand for PFM tools in the US, existing digital-only banks Chime and Simple both focus on reducing the costs for customers. Chime, for example, does not charge any fees for overdrafts, minimum balances, monthly maintenance or services, or foreign transactions. GlobalData’s 2019 Payments and Banking Survey found low fees and fares to be the number one reason for consumers choosing a particular financial services provider.

Therefore, Monzo will also have to offer similarly free or low-cost services to try and compete with these two established banks in the US market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn the US, banks charge for using other banks’ ATMs, and do so via the ATM owner so as to save money on ATM withdrawals. This system favors the larger US banks such as Wells Fargo, Chase, US Bank, and Bank of America, as these banks have the largest ATM networks and so users can withdraw for free if they have a current account with one of them. Chime and Simple charge no fees regardless of where the money is withdrawn, so they only have to pay the ATM owner.

Both banks have also linked up with different ATM partners to offer their customers totally fee-free ATM withdrawals. To compete with these other challenger banks, Monzo will have to offer a similar service and consequently absorb these costs.

While these challenges could prove tricky for Monzo to overcome, the bank could still potentially achieve success by out-marketing the competition. However, Monzo CEO Thomas Blomfield reportedly prefers an even mix of paid and word-of-mouth signups, as opposed to a heavily reliance on advertisements. Therefore, it does not look as if Monzo will out-perform other US banks in the marketing department either.

Monzo’s move to the US is a daunting one, made more so courtesy of these four tricky challenges. Combat these, however, and its survival in the US will be a genuine possibility.