Regulators in Indonesia are looking to consolidate the banking industry and attract foreign direct investment. Having imposed tight controls on bank ownership, lending, and signing up customers – in part to protect the country’s banking industry – the pendulum is now swinging towards regulatory relaxation.

The recent relaxation of M&A banking rules means foreign and local banks can now acquire a majority stake in all deals under IDR5tn ($354.4m). The Indonesian financial services regulator have also said they will not discriminate against either local or foreign banks, which is a promising sign. In an environment encouraging M&A activity, this could be a major opportunity for large banks looking to establish themselves in this populous, emerging market with low financial services penetration.

Part of this opportunity lies in the country’s developing status. Over 40% of the population remains unbanked, with many consumers only holding a savings account or insurance. For example, the mortgage product penetration rate is only 15%. Indonesia has proven profitable, as GlobalData’s Global Retail Banking Analytics database shows average returns on assets in Indonesia in 2017 were 6.3%, compared to just 1.9% for the Asia Pacific region.

Not all banks will be able to prosper from this favourable market. The ones likely to succeed will need to be able to work well with regulators, as well as needing plenty of capital to acquire smaller banks. Just as importantly, the ideal bank will need to be able to connect with Indonesian consumers, who value a reputation for stability as the most important attribute in a financial services company. This means large, regional banks will have a clear advantage.

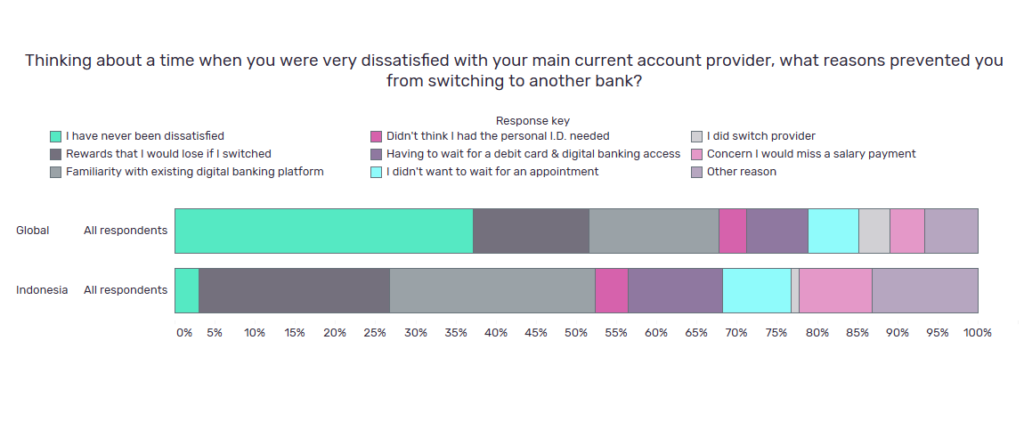

Customer dissatisfaction in Indonesia is also significantly higher than the global average. Whilst almost 60% of Indonesians were dissatisfied with their current provider, half of these consumers did not switch due to losing their current rewards or familiarity with their existing digital banking platform, with a further 12% not wanting to wait too long for debit card or digital banking access.

GlobalData’s 2019 Banking and Payments survey shows banks should match rewards and develop an intuitive, fast-access digital banking service to persuade consumers to switch providers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

The culmination of these factors make large banks well suited to this market. Their strategy should be to communicate to consumers that they are longstanding, trusted institutions where customers’ money is safe, while offering faster on-boarding, reward portability, and strong digital experiences.