JPMorgan Chase currently has the second largest number of branches in the US. However, in recent years it has followed the trend of other US banks, such as Wells Fargo and Bank of America, by closing many of them down.

JPMorgan Chase has shut over 550 branches since 2013. Yet, in a U-turn it recently announced plans to open 400 new branches in the next five years, including 90 branches this year.

The decision comes as little surprise, as the firm’s number of branches was not the only figure in free fall. Since 2010, it has also registered a dwindling market share in both credit cards (-0.7%) and loans (-1.2%), according to GlobalData’s Global Retail Banking Analytics. The detrimental effect of severely reducing its branch network, and its subsequently hampered ability to compete with other banks, was the clear motive behind the U-turn.

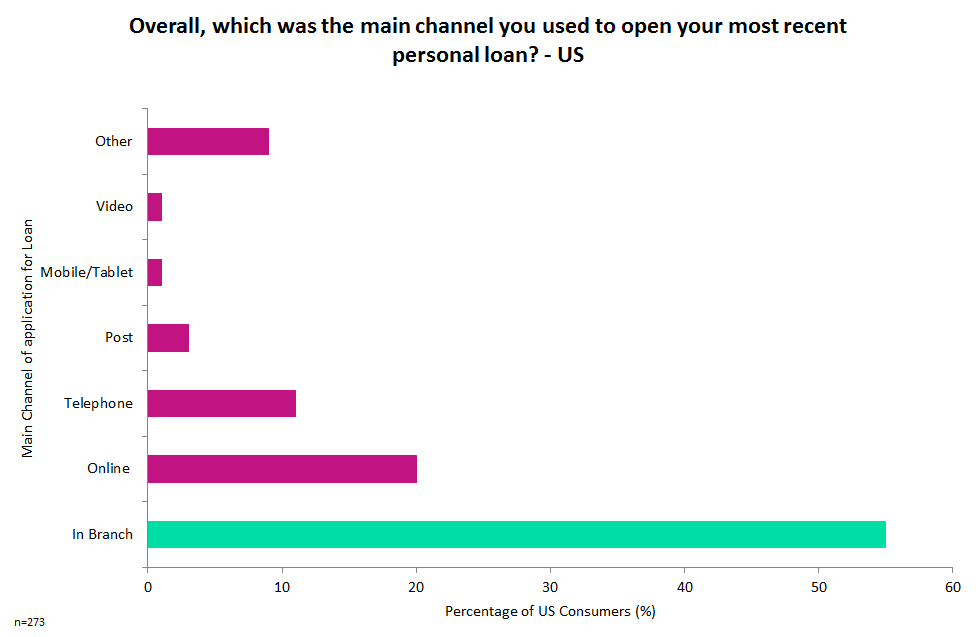

GlobalData’s 2018 Retail Banking Insight Survey highlights the importance of having a wide-ranging availability of bank branches. This was the main channel of application for 55% of Americans requesting a loan, while 52% stated it was their preferred channel for speaking with an adviser.

This goes hand in hand with JPMorgan Chase’s goal to not just open new branches but improve its relationships with clients. Thasunda Duckett, CEO of company subsidiary Chase Consumer Banking, claimed the move “is so much more than building branches”, adding: “This is about new customer relationships, better access to credit, and local jobs.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFrom this information it is clear why JPMorgan Chase has changed its position. Other banks should also consider following suit, as many also risk suffering the drawbacks of a condensed branch network.