In recent years media attention surrounding new digital banks has increased, unsettling incumbents and exciting millennials. Yet as per GlobalData’s 2018 Retail Banking Insight Survey, only 35% of millennials indicated a willingness to use a digital-only bank.

Of the remaining 65%, the majority are smartphone-dependent, tech-savvy consumers – with two out of three using mobile banking as least once a week. Incumbents should take comfort from the fact that the idea of a digital-only bank was unappealing to a significant proportion of millennials. After all, these consumers are supposed to be the main target audience of digital-only banks.

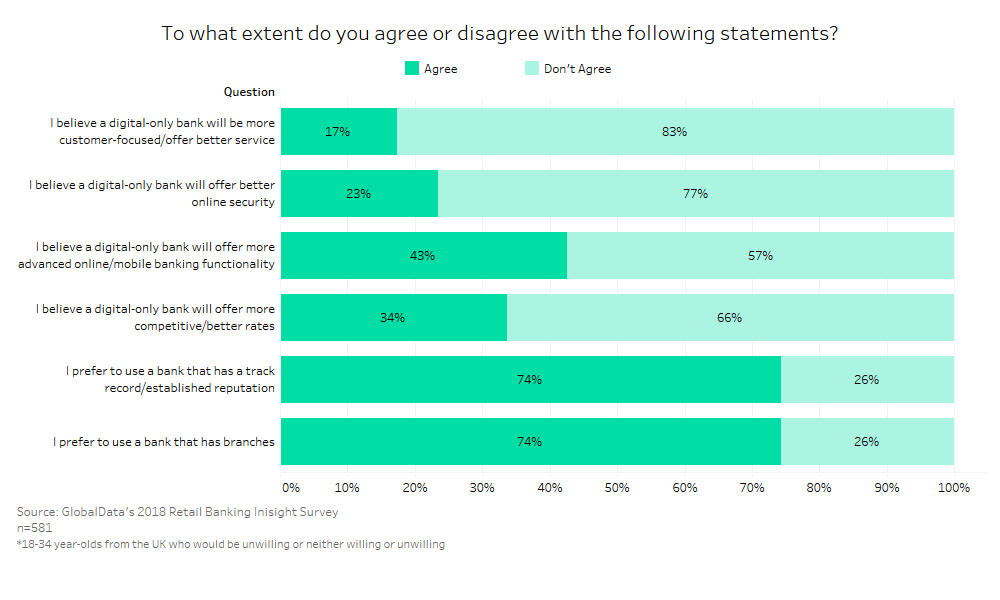

Approximately three quarters want to use a bank with a physical presence and an established reputation. Indeed, trust is helping incumbents retain millennial customers more than apathy. This is also evident when looking at responses on customer service and security. Approximately eight in 10 millennials who were unwilling to use a digital-only bank did not believe security or customer service would be better.

Incumbents should also take comfort in the fact that the supposed strengths of digital-only banks – namely superior mobile banking functionality and competitive rates – are not widely perceived. This suggests the gap reduction and pricing strategies pursued by incumbent banks are working (at least to some extent) and should be continued.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData