By Madeleine Sander, Head of Corporate Development, Hauck & Aufhäuser Privatbankiers.

Madeleine Sander describes the story behind creating Zeedin – an innovative digital wealth management offering for affluent customers – and shares her views on the benefits of a customer-centric, agile approach to rolling out the new hybrid robo-advisory solution from CREALOGIX.

Hauck & Aufhäuser Privatbankiers AG is a private bank based in Frankfurt am Main with a history going back to the foundation of Georg Hauck & Sohn Bankiers in 1796. Our long story has been one combining entrepreneurial spirit and a dedication to building long term client relationships.

In the 21st century, being a leading private bank means being both traditional and modern, and when it comes to technology we believe this means that software makes us better at serving our clients personally.

Hauck & Aufhäuser has a vision of leading our market with the creation of a comprehensive digital financial ecosystem for our clients that augments rather than replaces the personal touch in investment advice.

Successful launch of Zeedin

Two years ago we began work on a new component of our digital plan: to enable our clients to access a much wider range of self-service investment products while staying true to our personal advisory strengths.

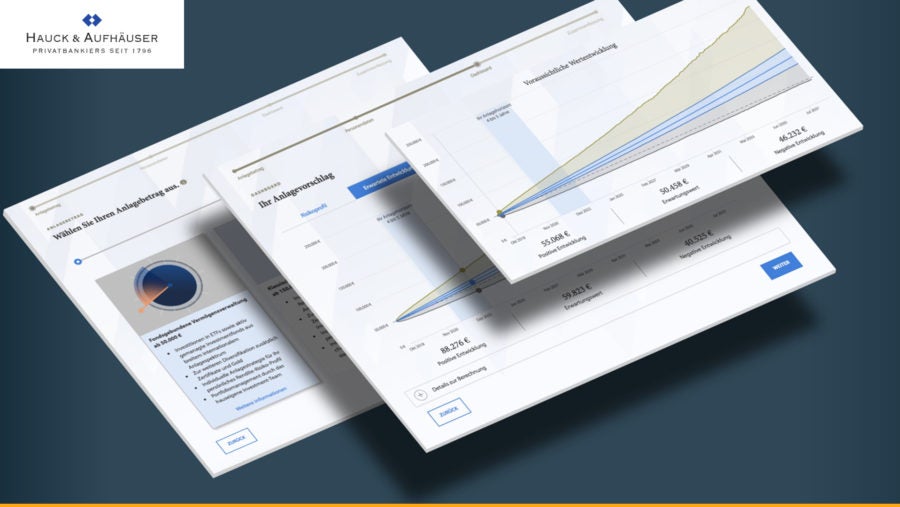

Hauck & Aufhäuser named this new digital asset management platform Zeedin. New investors are offered three tiers: unit-linked asset management from €50,000, classic single-asset management from €150,000 or ethical single-asset management from €300,000. We’ve created a unique solution in the market to suit an affluent digital investor.

New clients can sign up without the need for paperwork or a face-to-face meeting and can complete one factor of the required identity verification using video captured on their mobile device.

Hybrid advisory

While being designed to allow completely self-service uptake from new investors and existing clients, when we created Zeedin we also wanted to take account of the fact that investments of over €50,000 are likely to be part of a complex personal financial plan. The software, therefore, offers a hybrid approach, making it easy for prospective and existing clients to get advice through the application.

Clients can ask questions via chat directly to experts from the bank and support from advisors includes the ability to co-browse securely. This is in addition to routine contact routes via chat, telephone, or personal appointment. This choice of channels for accessing personal support is a key differentiator for an established private bank serving affluent clients, compared to mass market “lite” investing platforms offering little or no guidance.

The Zeedin digital asset management system allows our customers to compose very personalised investment strategies themselves via three different main product variants as well as the ability to invest directly in individual securities instead of just funds or ETFs.

More information and guided onboarding are available for German residents via the website at: zeed.in

Agile development

We laid the foundation for this with the introduction of a new online and mobile banking platform in April 2018. The second release followed in September, and from October 2018 our customers were able to start investing their assets in Zeedin. Looking back over the year, I am almost amazed at what we have achieved in such a short time.

Overall, the speed of implementation was very important to us because this is only the beginning of a longer-term strategy to confirm our position as digital leaders in private banking.

We chose to work with the banking software provider CREALOGIX, firstly because of their reputation with over 20 years in banking technology including many leading private banks and wealth managers. Secondly, CREALOGIX was able to offer us a beneficial balance of ready-to-deploy products with a high degree of customisation. This is achieved by the modular nature of CREALOGIX’s software products and their agile approach.

Agile methodology is very important to us at Hauck & Aufhäuser because, in essence, it matches our philosophy of putting the client at the centre of everything we do. When we designed Zeedin we wanted to put ourselves in the minds of our customers and see their challenges from their perspective. Working closely with developers at CREALOGIX, this enabled us to articulate a vision that matches our high-quality standards and offers modern design and usability across mobile and desktop user journeys.

One of our realisations was that people don’t necessarily complete onboarding to a new digital wealth management platform all in one go. This should not be regarded as a failure or abandonment: rather, the platform should make it easy to pause and resume progress at the convenience of the customer, even if they change device. If the customer is experiencing any uncertainty, we’ve integrated quick and easy routes to get expert assistance.

Learning from customers

Another agile principle we love is that the product is not considered static. We continue to work with our software partners in small sprints so that we can continuously deliver improvements to customers. As mentioned, the customer is at the centre so we keep a close feedback loop between our advisors and our product developers.

This is an advantage of a private bank: we can really listen to individuals, who are often managing complex financial affairs, and now we can use technology to make their lives easier in more specific ways than high street retail banks.

In conclusion, like Zeedin, we don’t see human expertise as being in contradiction to digital channels. By understanding customers and delivering practical, secure, and convenient features that help with their finances, we can prioritise technology that enhances our personal banking relationships.