Twice a year, the CMA releases its independent survey of the largest UK retail banks. This is always a good read and has been running since August 2018. So, the data released this morning represents the thirteenth survey since it launched.

There is a degree of predictability to the findings and this set of results covering the period from July 2023 to June 2024 does rather represent history repeating itself, with three notable changes.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

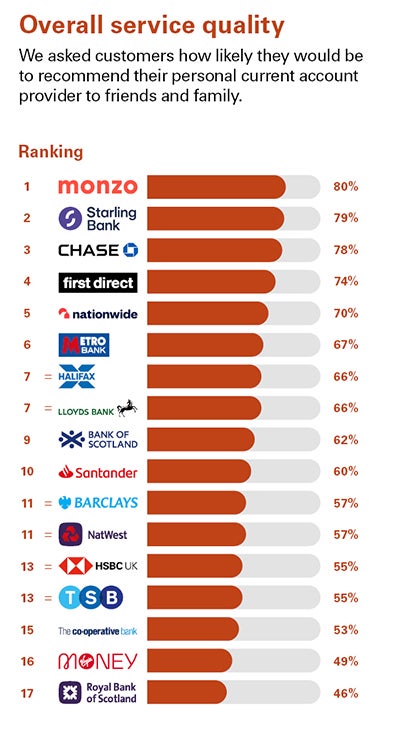

By GlobalDataFirst off, well played Chase UK. The UK brand of the largest US retail bank features for the first time and ranks third on its debut, just behind Monzo and Starling Bank for personal current accounts, overall service quality.

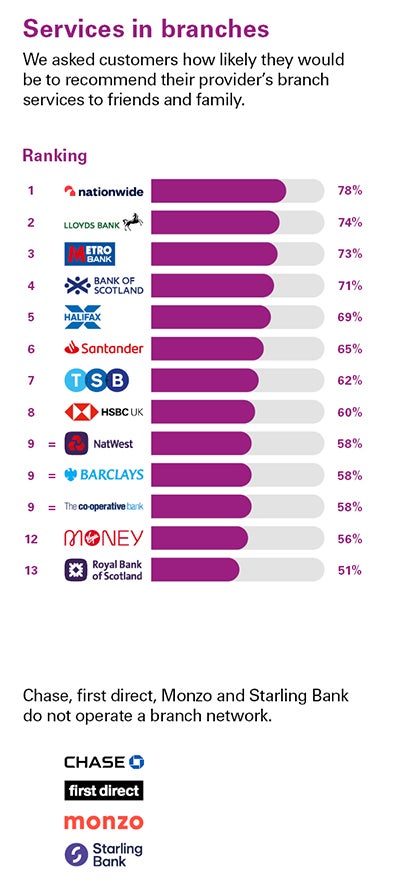

The second stat to jump out relates to Metro Bank and Nationwide in the separate service quality in branches survey. In the first 11 surveys from August 2018 to August 2023, Metro Bank ranked top. In the 12th survey, Metro Bank ranked joint top with Nationwide. In all 12 surveys to date, Nationwide ranked in the top three in this category, except in August 2023, when it ranked fourth.

Lloyds brands strong branch performance, Nationwide topples Metro Bank

Today, Nationwide ranks top in this survey with Metro Bank in uncharted territory down in third.

And the third stat to merit a mention relates to the Lloyds Banking Group brands. Lloyds (2nd), Bank of Scotland (4th) and Halifax (5th) all perform strongly in the branches category.

Elsewhere and at the wrong end of the rankings, it is a case of the same old story. Regular as clockwork, the same brands are named and shamed.

Virgin Money and RBS, again, are at the bottom of the poll for overall service quality. They also rank at the bottom in the survey relating to branch service.

RBS: ranks bottom in 11 of the 13 surveys to date over 7 years

In the very first set of results in 2018, Clydesdale Bank (now re-branded as Virgin Money) and RBS ranked joint bottom, with 49%. RBS ranks bottom in the latest survey, making it 11 surveys out of the 13 to date when it is plumb last. RBS has not scored above 48% in any of the 13 surveys to date. Virgin Money has ranked as high as 11th equal in February 2020 with an overall approval rating of 56%. It last scored above 50% in February 2021 with 54%. Virgin Money is once again second bottom in the latest survey, for the fifth time in the last six surveys.

Monzo and Starling have been running rings around their established rivals for nine successive surveys now but do at least now have a new rival in Chase to challenge them.

At the top of the latest survey, Monzo (80%) ranks first ahead of Starling (79%). First Direct is another regular strong performer but drops to fourth this time on 74% ahead of Nationwide (70%) and Metro Bank on 67%.

In the nine surveys since August 2020, Monzo has ranked top on six occasions and joint top in the other three surveys. In the same nine surveys since August 2020, Starling Bank’s worst performance was third in February 2021. It has ranked joint top on three occasions and second on five occasions.

UK digital banks lead for customer satisfaction

Kurt Vogt Gwerder, Strategy Consultant at Curinos, sums it up all rather neatly.

“The CMA’s survey is an important one for the banking industry, especially given the role that word of mouth plays in the shopping journey of people looking for a new provider. 40% of respondents in our latest primary current account shopper survey say they rely on trusted recommendations when shopping for a new primary bank.

“Today’s results show that digital banks continue to lead the way for customer satisfaction. Why? These digital banks are less reliant on switching offers to entice new customers. Instead, they focus on creating and marketing a clear value proposition based on their target audience’s core needs to grow their customer base organically. This is enabling them to create strong reputations in the market, which in turn is allowing them to grow their share of primary customer accounts.

“Capturing primacy is massively important as it leads to a significantly higher capture of customer balances, product holdings, and future potential. This achievement is only possible with a great customer experience, something that digital banks such as Monzo, Starling Bank and Chase, are clearly delivering on given their performance in today’s survey results.”

Chase UK CEO comment

Understandably, Kuba Fast, UK CEO for Chase welcomed release of the latest survey. He told RBI: “This shows that consumers really appreciate banks that consistently put customers at the heart of their offering, and our pace of growth so far demonstrates that they are keen to do more of their banking with newer providers.”

“Since launching Chase we’ve really focused on giving customers an excellent service experience, so it’s fantastic to see the efforts of our teams make a difference and have customers recognise us for providing stellar service in the first year we’ve been included in the survey.”