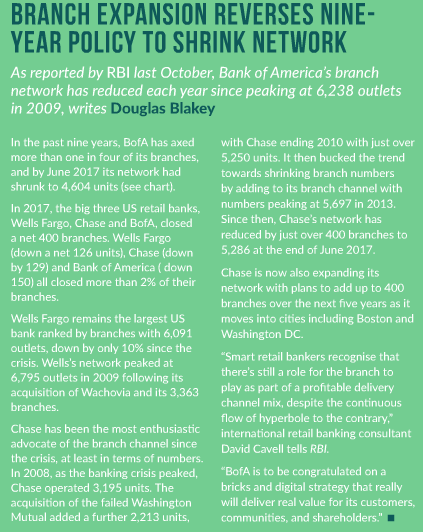

Bank of America (BofA) is expanding its branch network in a move that runs counter to the industry’s branch-reduction trend, and reverses its own policy in recent years of shrinking its network. Bryan Card, BofA’s senior VP, Financial Center and ATM strategy, explains the bank’s objectives to Robin Arnfield

In February 2017, Bank of America announced plans to open over 500 branches over the next four years, as it expands into new retail banking markets such as Ohio. It recently expanded its retail branch presence in Denver, Minneapolis and Indianapolis.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“Our goal is to connect our franchise network from coast to coast, and not just to win new clients but to provide additional products to existing clients in the states we’re entering,” Bryan Card, BofA’s senior VP, Financial Center and ATM strategy, tells RBI.

The branch expansion policy also represents a U-turn in recent BofA branch channel strategy. BofA currently provides commercial and business banking, as well as wealth management services through Merrill Lynch, to over 775,000 customer relationships across Ohio.

Increasing BofA’s retail footprint in Ohio, a state where it already has a strong wealth management presence, is part of its strategy to cross-sell retail banking services to Merrill Lynch customers.

BofA is offering cash and interest-rate incentives to Merrill Lynch clients who bank elsewhere, to encourage them to open first-time current and savings accounts, Reuters reported in January 2018.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

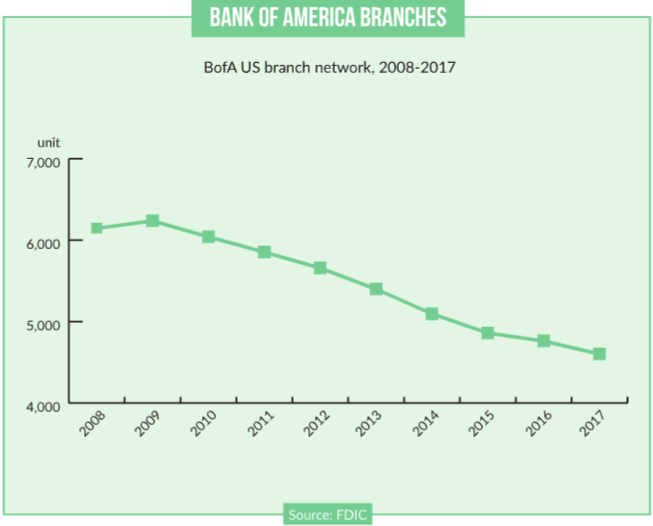

By GlobalDataAs reported by RBI last October, BofA’s branch network has reduced each year since, peaking at 6,238 outlets in 2009. In the past eight years, BofA has axed more than one in four of its branches, and by June 2017 its network had shrunk to 4,604 units. Rival bank Chase is also expanding its network with plans to add up to 400 branches over the next five years as it moves into cities including Boston and Washington DC.

“Smart retail bankers recognise that there’s still a role for the branch to play as part of a profitable delivery channel mix, despite the continuous flow of hyperbole to the contrary,” says international retail banking consultant David Cavell. “BofA is to be congratulated on a bricks-and-digital strategy that really will deliver real value for its customers, communities, and shareholders.”

Refurbishment

BofA also plans to redesign over 1,500 existing branches with new technology, furnishings and layouts, and add over 5,400 certified advisers and other staff.

As part of its branch development plan, BofA has already completed 620 branch renovations and opened over 160 new branches including 13 high-technology Advanced Centers. Over 3,500 Digital Ambassadors are located in BofA branches to help clients become familiarised with the bank’s latest digital technology.

Nearly 600 branches have dedicated interactive learning areas – Digital Gateways – with iPads to allow clients to learn about and try BofA’s mobile banking service and its products and services.

“The types of branches we are introducing depend on specific client needs and on different geographies,” says Card. “There is a lot of desire from our clients to use mobile banking and ATM channels, as well as face to- face interaction with our staff. Our branch network is still a very important part of our channel network and complements our other channels. There is a need to offer multiple channels and multiple ways to bank.”

Card says BofA is seeing continuing growth in customers using its mobile banking app to make face-to-face appointments with its staff.

“This feature is part of our strategy to let clients do their banking when and where they want,” he notes. “We’re putting our mortgage lending officers, financial solutions advisers and business bankers up front and centre in our branches to show we offer a full set of financial solutions that our clients might need.

“We also offer speciality banking centres focusing on segments such as businesses and students, plus a number of community branches where we educate people about financial basics such as understanding credit scores.”

Advanced Centres

BofA began piloting Advanced Centres in 2017. “The Advanced Centres provide a full set of financial services – both transactional and sales – virtually, as they are unattended,” says Card.

“Customers can talk to our advisors via video links at the ATMs housed in the Advanced Centres. They enable us to extend our hours of operation for our clients to times that are convenient to them, and are a hybrid between traditional attended branches and fully digital banking.”

Card says BofA is seeing great adoption of its Advanced Centres across all its customer demographics. “The Advanced Centres can be used across all client segments and all demographics, including prospective clients,” he explains.

Survey

A February 2018 survey by banking analytics firm Novantas found that 60% of Americans would still rather open current accounts in person at bank branches than on phones, tablets or desktop computers. The survey also found that half of US customers feel that online-only banks are “less legitimate” than those with branches.

“BofA’s strategy of enhancing its branch network alongside its digital proposition

recognises that, for many consumers, face-to-face contact is still important, despite all

the hype about digital,” reports GlobalData’s Retail Banking Insight survey.

The report adds: “That is particularly true when initiating new relationships, where branches remain a hugely important customer-acquisition channel. The survey found that 73% of US consumers who opened a checking account during 2015-2017 used a branch as their main application channel.

Digital Banking

BofA’s branch-expansion strategy goes hand in hand with its continuing enhancements of its widely acclaimed digital banking platform. In February 2018, BofA said it would make further updates to its mobile banking app, such as the launch of its Erica virtual financial assistant, following enhancements it launched in 2017.

Erica assists with tasks such as accessing balance information, transferring

money between accounts, navigating the mobile banking app, and sending money via Zelle, the US inter-bank peer-to-peer transfer service.

From April 2018, clients can complete a mortgage application within BofA’s mobile app, which will save them time by prepopulating their information. The digital mortgage application tool will integrate with BofA’s Home Loan Navigator, which allows clients to track their loan 24/7, upload documents, and review and acknowledge disclosures on their mobile device.

Launching this summer, the MyRewards digital hub will allow clients to access and redeem BofA rewards across all products in one place, including any BofA credit card,

BankAmeriDeals and Preferred Rewards.

Last year, BofA added a dashboard to the mobile banking home screen allowing customers to customise tiles to the features they use most, including account balances, card rewards, the spending and budgeting tool, FICO scores, mobile alerts and Zelle.

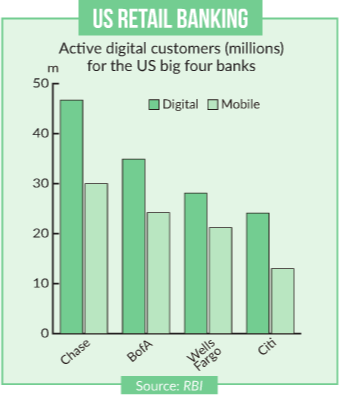

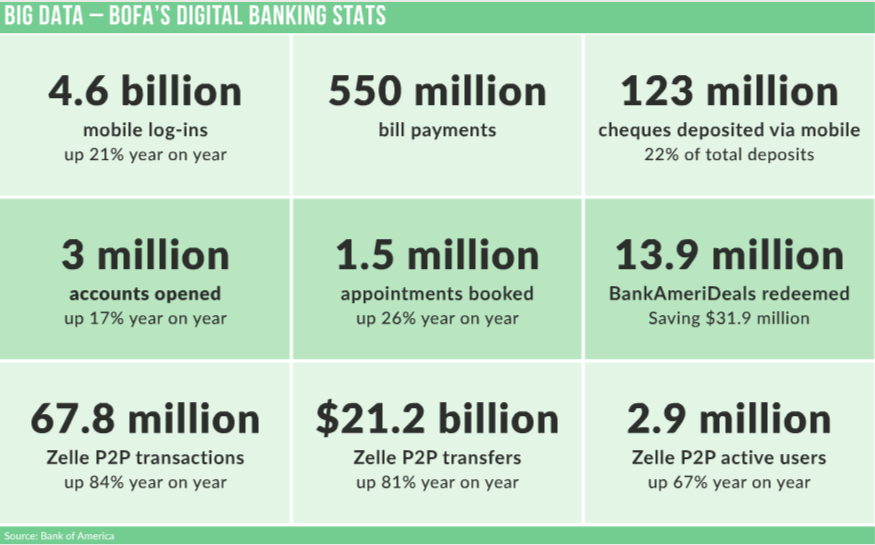

The Bank by Appointment feature was updated to enable mobile and online customers to schedule appointments in real-time with notaries, relationship bankers, managers or specialists. The new feature offers greater personalisation, as customers can choose from an expanded selection of investment topics to discuss with a specialist. BofA currently has 35 million digital customers, including over 24 million active mobile users.

During 2017, mobile banking customers logged into their accounts 4.6 billion times, or approximately 190 times per user, and deposited 123 million cheques via mobile. In 2017, BofA processed nearly 68 million Zelle transactions, and in January 2018, BofA said it had nearly three million active users of Zelle.